Wendell woman shares warning after being dropped by insurance for filing two claims

A Wendell homeowner wants to spread the warning after her carrier dropped her following two claims.

Posted — UpdatedA Wendell homeowner wants to spread the warning after her carrier dropped her following two claims.

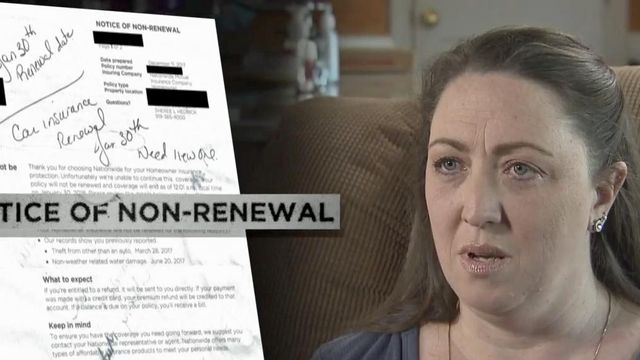

Pam Pettit's first claim covered a $2,500 loss after a garage break-in. Three months later, her washing machine leaked, causing about $8,000 in damage.

"It's not anything that you can expect or plan for," Pettit said. "It just happens, and it just so happened that it happened all in the same year for us."

Her carrier paid both claims, no problem.

Thirty days before her renewal, Pettit got a letter from her insurer saying they would not be renewing the policy because of those two claims. They got her labeled high risk.

"They told me straight out `you're a high risk now'," Pettit said. "I'm like 'how am I high risk?' I didn't do anything wrong."

"You pay for insurance, it's just like health insurance, life insurance because things can happen and it did," Pettit added. "And then they decide that well, because you used us, we're gonna drop you."

The news was especially surprising because the Pettits believed they were in good standing with the company.

"We actually had discounts with them because we hadn't had any claims," Pettit said. "I had no idea anything like this could happen and none of my friends had ever heard of it either."

Something else many people don't realize, many insurance companies track every claim filed, even every call made about an incident. There's actually a report on each and every one of us.

It's the Comprehensive Loss Underwriting Exchange, or C.L.U.E., and it covers homeowners, renters and car insurance. It gives insurance companies a seven year recap of all claims, and often even any contact you made with your insurer.

5 On Your Side asked North Carolina Insurance Commissioner Mike Causey about contacting your insurance company about claims.

"If you make that call to the insurance company, let's say you're considering filing a claim, most likely that's gonna trigger a file, going into the consumer file," Causey said. "Even if you end up not filing a claim, you made the call and indicated you had some damage. So they need to be careful when they make those calls, why they're making those calls."

Even when filing a claim, Causey says, proceed with caution!.

"You have to look at, is it worthwhile for me to file this claim for these smaller amounts," said Causey.

Industry experts note insurance is for catastrophic loss, damage so costly you can't afford repairs. Less significant losses should usually be paid out of pocket.

If you file too many claims, your rates could go up, or like the Pettits, you could get dropped altogether.

"I was kinda freaking out actually," said Pettit.

Getting replacement coverage, is not easy. Pettit called six different companies.

"We got lucky that one of them took us on, but only one would," said Pettit. "The other five declined to even look at our stuff with the things that we have on file."

Only one would insure their home, and at a premium. $320 dollars more each year for a similar policy.

Pettit hopes her experience alerts others to think twice about any claim or call.

"Never did we expect that we would be, pretty much basically dropped, at the end of our contract with them due to the fact that we used them for what we pay for," Pettit said.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.