Tax preparer Helen Johnson says she has not seen anyone claim anything on the Consumer Use Tax this year.

That could soon change. The state is starting a pilot program this fall that will make paying use tax on out-of-state items automatic.

"There's a tremendous potential for this project to revolutionize the way states collect use tax as well as sales tax," says Charles Collins of the N.C. Department of Revenue.

The state will set a few businesses up with software that will calculate a state's use tax automatically. It will be figured right into the customer's bill.

Not everyone is thrilled about this new program to make people pay taxes for online purchases.

"It's a lot of traffic, sure. A lot of businesses sure, but they designed it like that," says taxpayer Derek Adams.

Revenue officials say the reason is simple -- they are losing big money.

"From the individuals, we estimate between $110 and $140 million on the remote commerce, which is Internet, mail order and home shopping," Says Collins.

By the year 2003, the Department of Revenue expects to lose $240 million to Internet sales tax alone.

Three states will be included in the pilot program this fall, although 26 states are interested. Revenue officials hope to have the program operational in a year and a half.

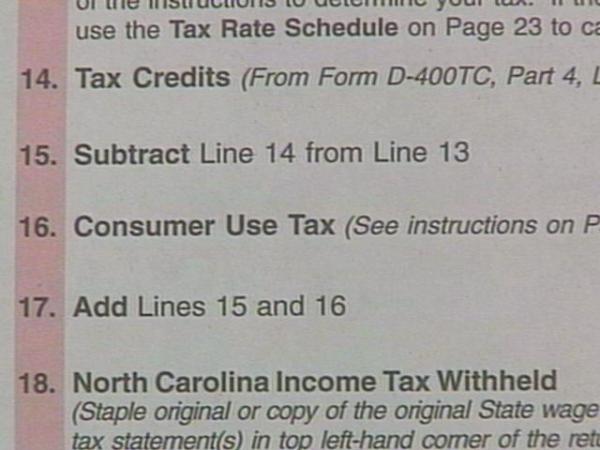

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.