Report: Charitable contributions at four-year low in NC

New data released Tuesday shows that Tar Heel residents cut back on charitable giving for a second year in a row, giving $21.4 million.

Posted — UpdatedThe report doesn't look at all charitable causes, just those that use paid solicitors, or professional fundraisers.

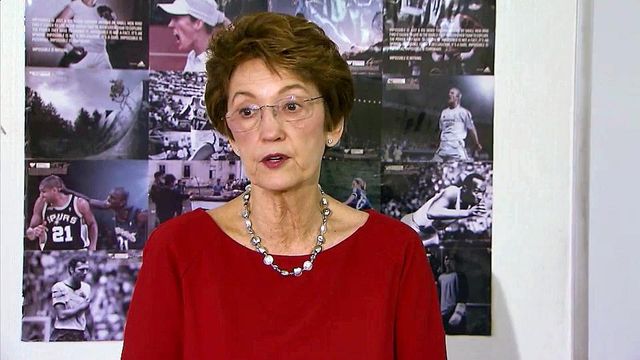

One reason for the decline, Secretary of State Elaine Marshall said at a news conference Tuesday, is that fundraising campaigns have brought in smaller donations than previous years.

"North Carolinians are still struggling to meet their own families' needs," she said. "They are still struggling to have the confidence in their own personal budgets to feel like they have the ability to donate."

But charities that use professional fundraising services are also getting less of each dollar contributed to their causes from those campaigns.

Last year, according to Marshall, charities received an average of about 50 cents on each dollar raised. This year, they received an average of 42 cents per dollar.

Many received less than that.

Disabled Veterans Services Inc., for example, received about 15 percent of contributions from professional fundraising; Easter Seals Inc. received less than 12 percent; and Defenders of Wildlife received 4 percent.

Those numbers do not account for direct contributions.

Other charities fared much better.

Raleigh Rescue Mission, for example, used 81 cents on the dollar of its contributions. Marshall said it's a charity that is savvy about using fundraisers.

But others are not.

"People used to just enter into kind of any old contract, because they took the notion that 'we can’t do it ourselves, and if we only get 20 cents on the dollar, that’s better than what we could do,'" Marshall said.

Sometimes, there are valid reasons for lower-than-expected numbers.

For example, Marshall said, educational efforts might be important to the fundraising program, but in accounting terms, those kind of efforts are considered to be part of the expenses.

Another reason could be that data might come at the beginning of a fundraising cycle when expenses are high but donations have not started coming in.

When it comes to giving, Marshall urges the public not to stop giving but to do so carefully.

"Many have record-level needs this season, so please give," Marshall said. "But give with knowledge. Do your homework."

To get a clear picture of any one group’s relationships with solicitors, donors should look at the group's reports on file over a period of several years. Donors can also request financial information directly from the charity.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.