High-risk pool to provide insurance option for many

North Carolina will launch a federally subsidized high-risk pool on July 1 for people with pre-existing medical conditions, which usually make purchasing individual insurance prohibitively expensive.

Posted — UpdatedAs part of the national health care reform effort, the state will launch a federally subsidized high-risk pool on July 1.

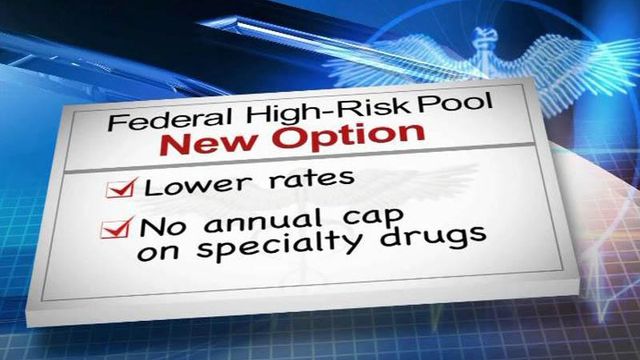

For people with pre-existing medical conditions, purchasing individual insurance can be prohibitively expensive. Participation in the high-risk pool could lower premiums by about 80 percent, from an average of $3,000 down to $600 a month, said Michael Keough, executive director of Inclusive Health, which will operate the federal pool in North Carolina.

About 3,600 people statewide with pre-existing conditions already purchase insurance coverage through Inclusive Health, which was created by the General Assembly in 2007 and launched a state-subsidized high-risk insurance pool last year.

The addition of a federally funded high-risk pool could cover another 8,000 people in North Carolina, Keough said. Still, that is a small fraction of the estimated .

The federal government set aside $5 billion under the Patient Protection and Affordable Care Act to fund such high-risk pools nationwide. The pools are a stop-gap measure to provide coverage to residents considered to be insurance risks, and by 2014, they will be replaced by health insurance exchanges that must charge all members the same premium, regardless of any medical conditions they might have.

"The idea is that (the federal high-risk pool) expands on and improves on the work of state risk pools like us by lowering the rates, improving coverage and reducing some of the barriers," Keough said.

North Carolina will receive about $145 million for its federal high-risk pool. Although there are an 200,000 uninsured state residents with pre-existing conditions, the funding will limit the number of people who will be served by the pool in the next few years.

Thirty other states will also operate their own pools, and the federal government will manage the pools in the remaining states.

To qualify for the new federal high-risk pool, an individual must be a U.S. citizen or legal resident, have a pre-existing medical condition and have been without insurance for at least six months. The state pool also accepts residents who cannot afford coverage through their employer's insurance policy.

"We're intended to be the insurer of last resort," Keough said.

Marianne Taylor said she hopes she can take advantage of the subsidized premiums offered by the high-risk pool.

Taylor, who books musical acts for local bars, has gone without health insurance for 10 years because she can't afford it. The 57-year-old suffers from an irregular heartbeat, fibromyalgia and arthritis, but she hasn't seen a doctor in years and uses over-the-counter medications to treat her pain.

"I want to pay for health care. I just can't, and there needs to be some way that people like me can be helped," Taylor said. "I've got a lot of life left in me."

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.