Local News

Rocky Mount QVC employees under investigation

A spokeswoman for the company said the employees are under investigation for irregularities in emergency withdrawals from their 401K plans. She would not say how many employees.

Posted — UpdatedROCKY MOUNT, N.C. — Dozens of employees at a QVC distribution center in Rocky Mount were turned away as they reported to work Wednesday.

A spokeswoman for the company said the workers are under investigation for irregularities in emergency withdrawals from their 401K plans. She would not say how many employees and declined to comment further.

Employees who gathered near the plant in protest told WRAL News that as many as 150 employees might be affected and that they are on unpaid leave, pending the outcome of the probe.

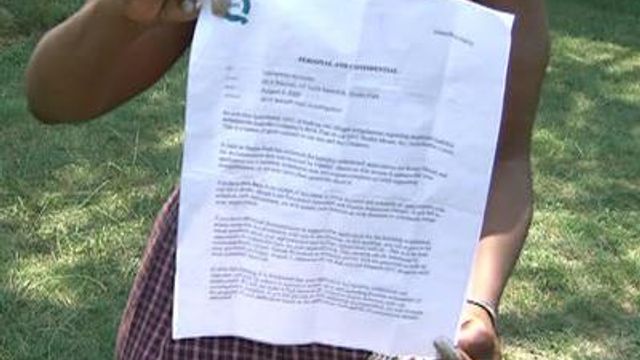

They said they received letters Wednesday morning, advising them to schedule a meeting within 48 hours with a company loss prevention specialist and human resources representative to prove the hardship loans were legitimate.

"Failure to set up a meeting will indicate your decision to voluntarily resign from the company," the letter stated.

Employees found to have improperly applied for the loan could be terminated, it continued.

"We cannot have this," QVC employee Layvonne McCauley said. "We have families. We are in dire need of hardship. We are in dire need of our jobs."

The plant, which employs about 900 people in the Rocky Mount and Edgecombe County community, has imposed a salary freeze, cut back on overtime and hours and started paying employees bi-weekly, instead of weekly, employees said.

The changes, they said, have forced them to tap into their 401K accounts.

Fidelity, the company that holds the 401K plan, they continued, reviewed and approved the loan applications and sent them the checks.

"It just seems like (QVC is) betraying me," employee Yeshica Lynch said. "If they had any problems with it, Fidelity should have approached me, not QVC."

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.