Judge shuts down real estate investment scheme

A Fayetteville real estate investment scheme was shut down Wednesday after leaving dozens of people with loans they can't afford and rental properties that are worth far less than what they paid for them, Attorney General Roy Cooper said.

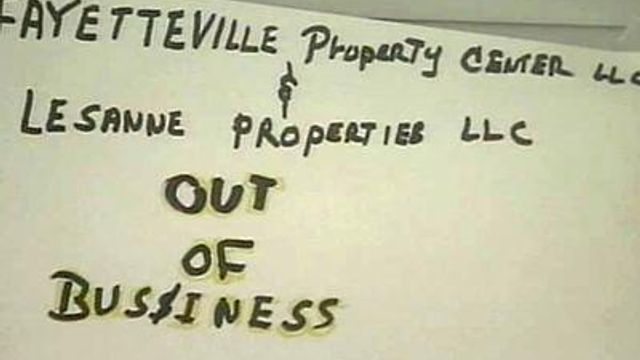

Posted — UpdatedUnder a consent judgment signed today by Wake County Superior Court Judge Paul Gessner, Maurice Jenkins, Lessane Properties LLC and Fayetteville’s Property Center are barred from misleading people to get them to invest in rental properties in the Fayetteville and Triangle areas.

The case against two other defendants, Holly Stevens and The Eddie Peyton Group, is pending, but officials said they believe they have ceased operating in North Carolina.

The defendants told consumers they could make a profit by purchasing houses and renting them out without having to pay any money down, Cooper said in a statement. Jenkins funded his scheme by misrepresenting the value of the properties he sold to consumers, leading them to take out mortgages and lines of credit for more than the properties were worth, he said.

"Consumers looking to invest in real estate got snared by a complicated scheme that left them with lots of debt and no profit,” he said.

James said he was told he could make a $500 monthly profit by buying and renting out houses.

Public records in Cumberland, Durham, Harnett, Robeson, Sampson and Wake counties indicate that the defendants have sold more than 120 homes since 2004. Most of the houses were bought out of foreclosure for between $10,000 and $70,000 and then resold as rental properties for between $30,000 and $150,000.

According to Cooper’s complaint, the defendants promised to manage the rental properties and cover consumers’ monthly mortgage payments, taxes and insurance on the homes, as well as pay them $500 profit a month per house. But the defendants didn't charge enough rent to cover all of the promised payments – some of the houses weren't rented at all or were too damaged to be inhabitable, according to the complaint.

“Maurice Jenkins would come to them and basically convince them that they could make money without having to spend a lot of personal time and effort to do that,” John Briggs, James' attorney, said.

Some of the victims told officials Jenkins completed their loan applications, took them to meet with loan officers and told them how much money to borrow. In loan applications he prepared and submitted, he inflated borrowers’ incomes, exaggerated what they were going to pay for the properties, and misrepresented at least one borrower’s employment status, according to the complaint.

The defendants would then keep the loan money and fail to pay off the previous mortgages, leaving consumers stuck with two mortgages on a single property, according to the complaint. Some consumers didn’t find out that Jenkins hadn’t paid off the previous loans until they started to get foreclosure notices.

James said he bought more than 20 homes from Jenkins and obtained $700,000 in unsecured loans.

Cooper said he would pursue any of Jenkins' financial assets as restitution for the victims.

He offered consumers the following advice about real estate investment deals:

- Do your own research on the property and investment opportunity. Investing in real estate should not be an impulse decision. Don’t rely on the information that is provided to you by the developers or the people who are trying to get you to buy into the investment.

- Get an independent appraisal to check the value of the property. Never rely on the appraisal from the developer or seller. Hire an independent appraiser and be sure to check that he or she is a licensed appraiser in the state where the property is located.

- Consider having your own attorney review documents before you sign them to be sure that everything is accurate and above-board. Never sign a closing statement or loan papers that aren’t entirely accurate.

- If the opportunity sounds too good to be true, it probably is.

WRAL News tried to speak with Jenkins, but was not able to reach him Wednesday.

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.