Raleigh foreclosures up; home sales increase from May

Foreclosures were 64 percent greater in the second quarter of 2008 than in the same period last year. But a real estate group notes that home sales increased in June from May, and home values were up 5 percent from 2007.

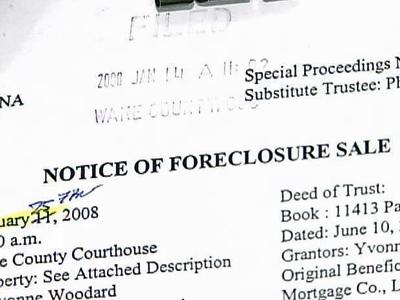

Posted — UpdatedRealtyTrac, an industry data group, said 1,515 homes had received at least one foreclosure notice.

Foreclosures were up 8.4 percent from May. The statewide increase for the same period was much more moderate at 2.2 percent.

Year-over-year statewide, the increase in foreclosures was almost 58 percent, for a total of 10,511 homes, the company said.

The rate in North Carolina is about half of the national average, where the foreclosure rate more than doubled in the past year, according to the data released Friday.

Nationwide, one in every 171 households was at some stage of the foreclosure process during the second quarter, RealtyTrac's data showed.

The statewide average price did dip slightly to $226,032, down 2 percent from a year earlier.

Soft housing sales, declining home values, tighter lending standards and a sluggish U.S. economy have left strapped homeowners with few options to avoid foreclosure. Many can't find buyers or owe more than their homes are worth and can't refinance into an affordable loan.

Foreclosure filings increased year-over-year in all but two states, North Dakota and Alaska.

Nevada, California, Arizona, and Florida continued to clock in the highest foreclosure rates. One in every 43 Nevada households received a filing during the quarter.

Cities in California and Florida accounted for 16 of the worst 20 metro foreclosure rates. Stockton, Calif., had the worst rate, with one in every 25 homes in the town receiving a foreclosure filing. That's nearly seven times the national average.

RealtyTrac monitors default notices, auction sale notices and bank repossessions. Banks took back more than 222,000 properties nationwide in the second quarter, the company said. Bank repossessions accounted for 30 percent of total foreclosure activity, up from 24 percent in the previous quarter.

Economists estimated 2.5 million homes nationwide will enter the foreclosure process this year, up from about 1.5 million in 2007.

Copyright 2024 by WRAL.com and the Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.