State moves to liquidate companies in Lindberg insurance saga

North Carolina regulators asked a judge this week to liquidate two insurance companies—a step that could eventually shut down the businesses and recoup money for policyholders.

The move comes more than three years after the state started questioning the whereabouts of more than $1 billion in insurance company assets within a wealthy businessman’s empire. And it comes as executives of the firms’ holding company say they are working on a sale that would make investors whole.

A judge still must sign off on the plan. And billionaire Greg Lindberg, once North Carolina’s largest political donor—now awaiting a second federal trial on bribery charges—is expected to fight it.

Several policyholders with Colorado Bankers Life Insurance and Bankers Life Insurance—the two companies affected by the filing—cheered the state’s move and are hopeful for liquidation, which could trigger payments in limbo for years.

“I am relieved to hear that the court is taking action, and I look forward to a, hopefully, quick resolution to the nightmare that has taken a toll on my wife and me,” Neil Martin, an 84-year-old policyholder, said in an email. “We need our money!”

Payments would be covered by state guaranty associations, which back the insurance annuities largely at issue, much like the Federal Deposit Insurance Corp. guarantees bank accounts. In North Carolina the guaranty limit is $300,000. The state Department of Insurance had hoped to avoid liquidation because these state-by-state limits mean policyholders won't automatically recoup their full investments.

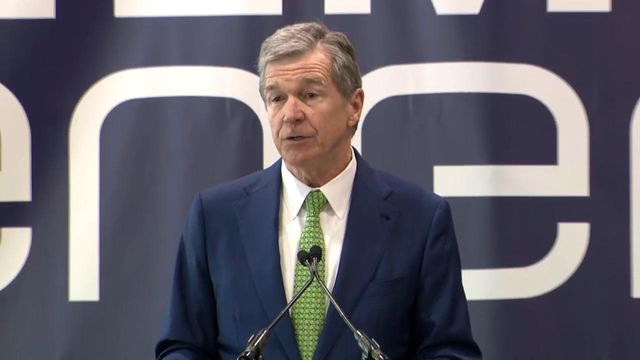

Based on a count last year, that would mean policyholder losses up to about $265 million, but Insurance Commissioner Mike Causey, the star witness against Lindberg in the insurance mogul’s first federal bribery trial, said in a statement that the department would continue to push for full payments even after liquidation. Lindberg, who at one point owned a complex network of hundreds of companies, faces multiple civil lawsuits from investors in various countries seeking payments they say they’re owed.

Lindberg has repeatedly accused Causey and the Federal Bureau of Investigation of railroading him, but those arguments have not moved judges or North Carolina’s attorney general.

Lindberg said through a spokeswoman Wednesday that the liquidation filing will only delay payments and that he has “a ready and willing buyer” prepared to purchase his insurance companies. A sale would get policyholders their money “in a matter of months,” Lindberg said. Lindberg, and his Durham-based holding company, Global Growth, wouldn’t identify the potential buyer, citing a nondisclosure agreement.

The legal team representing Causey has repeatedly expressed incredulity with Lindberg. A Wake County superior court judge said earlier this year that Lindberg defrauded his own insurance companies and reneged on an agreement state regulators expected to rehabilitate those companies, recoup a $1.2 billion shortfall and get policyholders paid.

Lindberg and the executive he picked to run Global Growth while he was in prison say there is no shortfall.

“The sale we're negotiating and the rehabilitation plan we proposed to Commissioner Causey would fully protect policyholders without a single policyholder loss,” Global Growth chief executive Justin Holbrook said in a statement.

“Of all the developments in this case, this one has to be the oddest,” Holbrook said. “We’re trying to work toward a resolution that would fully protect all policyholders, and at the last minute, Commissioner Causey has filed a petition to liquidate Global Growth’s affiliated insurance companies.”

Lindberg domiciled his insurance companies in North Carolina, apparently due to the state’s more relaxed laws on how companies can invest policyholders monthly premiums. He invested much of that money in various other companies he owns, something that would have been against the law in many states. North Carolina has since changed its laws, limiting these investments despite Lindberg donating more than $5 million to North Carolina political campaigns.

He was convicted in 2020 of trying to bribe Causey and sentenced to more than seven years in federal prison. That conviction got tossed by the U.S. Court of Appeals for the Fourth Circuit, which said the judge in Lindberg’s case gave the jury bad instructions.

Lindberg is set for retrial in March and maintains his innocence, saying Causey set him up because Lindberg supported Causey’s opponent in the 2016 election for insurance commissioner.

Lindberg also faces a U.S. Securities and Exchange Commission complaint alleging a “massive fraudulent scheme,” which he has denied.

Two other Lindberg companies, Southland National Insurance Corporation and a re-insurer called Southland National Reinsurance Corporation, are also in rehabilitation with the state, but they’re not affected by this week’s filing.

The state filed for liquidation for Southland National Insurance Corporation in March 2021. That liquidation, which is also opposed by Lindberg and his holding company, remains pending.

The timeframe of the Southland liquidation effort isn’t necessarily an indicator of how long the new liquidation petition would take to be implemented. Department of Insurance spokesman Jason Tyson said the Southland liquidation has “extenuating circumstances unique to that filing.”

An August update on the process notes that Lindberg’s holding company has been funding Southland’s “negative cash flow on a monthly basis,” and says regulators may ask the court to move forward with liquidation if that stops.