Rising homeowners insurance rates: Proposed increase gets pushback

State insurance regulators on Monday heard from the public about a proposal to drastically increase homeowners insurance rates.

Earlier this month, the North Carolina Rate Bureau asked the state to approve an average increase of 42.2%, claiming the industry is losing money insuring homes in the state.

Longtime realtor Helen Mayhew was one of many people who spoke against the change at Monday's public comment hearing.

Everyone who spoke was against the Rate Bureau's proposed increase.

"I am saying to you, this is ridiculous," Mayhew said.

The Rate Bureau, an independent agency representing the insurance industry, is not connected to the state Department of Insurance. The bureau is asking for a statewide average increase of 42% percent for homeowners insurance starting in August.

Fred Fuller was the designated hearing officer, leading Monday's public comment session on behalf of the State Department of Insurance. He'll report out to Insurance Commissioner Mike Causey, who has the final say on whether and how much rates will rise.

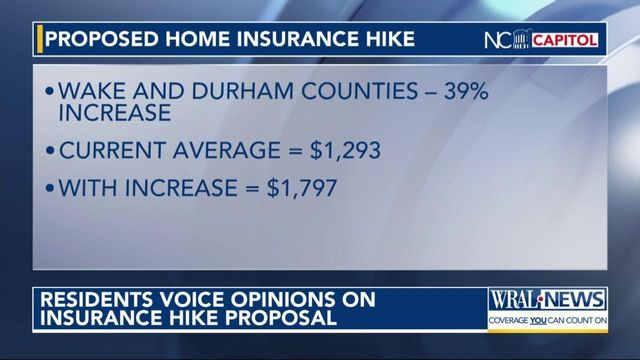

In Wake and Durham counties, the bureau is asking for a rate increase of 39%, which would increase a homeowner's average yearly insurance bill by more than $500.

Along the southeastern coast, the bureau is asking for a 99% increase for beach communities, which would increase the average yearly insurance bill in that area by more than $5,500 to $11,196.

The Rate Bureau said the colossal increase at the coast is due to climate change, which is causing more severe storms at the same time as more people are moving to the coastline.

However, Mayhew said it’s just too much for homeowners.

"We know we have climate change," Mayhew said. "We understand that. But that does not mean that's an excuse to ask those kinds of price increases."

The state Department of Insurance will negotiate with the Rate Bureau behind closed doors to come to a compromise increase.

Raleigh resident Rick Tucker told WRAL News he was disappointed that Causey himself did not attend the meeting to hear from ratepayers.

"It's absurd that he was not present. He should be listening to the voters," Tucker said.

A Causey spokesperson said he was advised not to attend. Because he has to play the role of judge in this situation, he must remain impartial.

Causey told WRAL News, "I have heard the comments today and the countless comments submitted by our citizens, and I take them all very seriously."

He said his department will consider carefully whether the Rate Bureau’s proposed increase is “excessive, inadequate or unfairly discriminatory.

“If it is, I will call for a hearing on the matter and will fight for our consumers to ensure that any proposed increase is reasonable and actuarially sound," Causey said. "Just to be clear, although the Rate Bureau submitted the requested increase, the request has not been approved.”

Consumers who have questions about their insurance can visit www.ncdoi.gov or call the department toll free at 855-408-1212.

In 2020, insurers asked for a 24% increase but ultimately got 8%. North Carolina is the only state in the nation to set its insurance rates this way.