Lawmakers plan to close sales-tax loophole

As they struggle with the new state budget and haggle over proposed cuts and tax increases, one subject lawmakers seem to agree on is closing a loophole in the state tax code that Lowe's Cos. uses to avoid collecting sales tax on some goods.

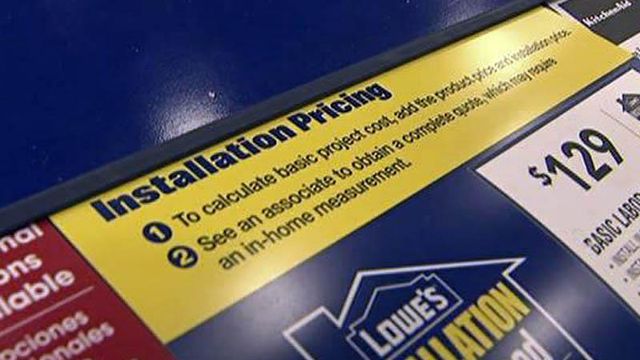

Mooresville-based Lowe's doesn't charge sales tax on items like windows, carpeting, tile, cabinets, counter tops and appliances that store contractors install. Customers pay the tax only when they buy the goods at a Lowe's store for a do-it-yourself project.

Lowe's officials maintain they follow the state law on contractor performance agreements.

The law states that contractors like plumbers and furnace repairmen pay what's commonly called a "use tax" for products used in repair projects and then roll that cost into the final bill, which doesn't include an itemized sales tax charge.

Use taxes likely bring in millions of dollars less to North Carolina's coffers than retail sales taxes would – most contractors get wholesale discounts, so the use doesn't include any retail mark-ups that a do-it-yourselfer’s sales tax would include. Lawmakers said they want to ensure the state gets the taxes owed as they try to erase a projected $4.6 billion deficit.

"It's a loophole that needs to be closed and bring some clarity to it and finality to it, and we fully intend to make sure that the state gets their fair share," said Sen. David Hoyle, D-Gaston.

"The idea is everybody ought to play by the same rules. Make them clear and consistent. We'll let everyone go out and do business and have a fair competitive fight," said Sen. Dan Clodfelter, D-Mecklenburg.

Lowe's competitors, from Home Depot Inc. to local home-improvement stores, charge sales tax on materials regardless of whether their crews install the goods for customers.

Andy Pittman of Jeffreys Appliance Center in Raleigh said Wednesday that he doesn't care that lawmakers are looking only at the added revenue generated by a change in the tax code. He just wants everyone to operate by the same rules.

"We're at a disadvantage of the rate of the sales tax," Pittman said. "If we're going to pay the taxes and that's the way the law is intended, then we want everyone to be on the same playing field we are."

Lowe's officials, who have battled with the state Department of Revenue for several years over the issue, said they believe they are following state law as written and would conform to any changes in the law.