Fees grow faster than nest egg in NC employees' pension fund

More than 900,000 public employees in North Carolina count on the state pension fund for their retirement.

The fund has grown through contributions and returns on investments, but not nearly as fast as has the rate of fees charged by outside managers.

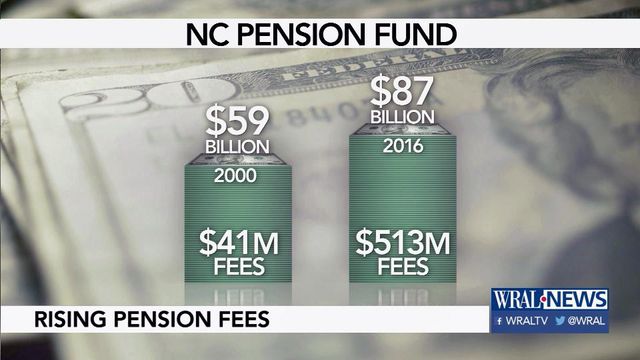

In 2000, when the state pension fund had about $59 billion in it, North Carolina spent $41 million on outside investment management fees.

As of the latest public report for the fiscal year ending in June, North Carolina paid $513 million to outside managers to help manage the fund, which now has about $87 billion in it. An annual report indicated that those fees could end up being far higher.

Richard Warr, a finance professor at North Carolina State University, says the increase in fees doesn't go hand in hand with an increase in the value of the fund.

"Paying higher fees doesn't earn you higher returns, which seems counterintuitive, and you wonder why anyone does it," Warr said. "But all the evidence shows that paying higher fees, in fact, results in lower returns because you're paying higher fees."

Warr said he believes the hard sell of Wall Street pushes pensions to private management and away from index funds that mirror market performance with far less expense.

In the past 16 years, the state pension fees ballooned more than 1,100 percent, overshadowing the fund's 47 percent increase. Brad Young, Treasurer Janet Cowell's press secretary, said the money in the fund is invested in a mix of private-market investments as well as traditional stocks and bonds so it remains diversified. Young says the diversified approach is Cowell's way of protecting the fund from market fluctuations.

"These investments have not only provided diversification but have done well. After all the fees are taken out, the Treasurer's private-market investments have produced an annualized return of 7.98 percent over the past five years, compared to 6.21 percent for public equity and 5.17 percent for fixed-income bonds," Young said in a statement. "North Carolina's investment programs are lower cost than other similar public funds, and North Carolina's investments have performed in the median compared to peers."

Dale Folwell, a Republican candidate for state treasurer and a certified public accountant, says the "experiment" of private management "has not worked."

"We're paying more fees for less performance. At the end of the day, my job as the keeper of the public purse is to preserve and strengthen these pension plans," Folwell said.

Dan Blue III, Folwell's Democratic opponent, echoed those sentiments and agreed that a change in course is needed.

"I would not be satisifed with the results. We need to look at ways to reduce fees, change allocation and balance risks," he said.

With investment returns regularly lagging below benchmark goals, more critics are doubting the value of outside fund managers.

"This is just wasted money," Warr said.

Ardis Watkins, a legislative affairs director for the State Employees Association of North Carolina, said SEANC has been trying to draw attention to "extraordinarily high fees" for some time.

"This price-gouging by Wall Street money managers is taking money out of the pockets of retirees in North Carolina. After the election, we hope there will be significant changes in the investment policies of the treasurer's office," Watkins said in a statement.

Cowell's office refuted those statements and the idea of using private managers as an "experiment."

"Today, the North Carolina Retirement Systems are the third-best funded pension system in the nation, and during Treasurer Cowell's term, the retirement system's assets have increased by 50 percent," Young said. "That's not an experiment, but a success story."