Fact check: Sanders says Bloomberg didn't support raising the minimum wage

U.S. Sen. Bernie Sanders welcomed Democratic rival Mike Bloomberg into the thick of the presidential primary with a slew of attacks on the former New York City mayor’s moderate record.

Speaking at a gathering of Democrats in Nevada, Sanders contrasted his own consistent support for raising the minimum wage with Bloomberg’s on-the-record opposition.

"We will not defeat Donald Trump with a candidate who in 2015 stated, and I quote: ‘I, for example, am not in favor, have never been in favor of raising the minimum wage,’" Sanders said.

We wondered if that was true, and it is. It’s worth clarifying that this is no longer Bloomberg’s position in 2020.

Bloomberg supports raising the federal minimum wage to $15 an hour, up from $7.25, putting him in line with the rest of his primary opponents.

Bloomberg preferred tax credit to wage hike

In 2015, Bloomberg spoke against raising the minimum wage:

"I, for example, am not in favor, have never been in favor of raising the minimum wage," Bloomberg said on the Bloomberg TV channel.

Bloomberg went on to describe what he would support: raising the Earned Income Tax Credit. Doing so, he said, would reduce the burden on employers and protect jobs.

"I think you should raise the income tax credit, which does the same thing for the same people, but it spreads the burden across all the taxpayers rather than just a small number of businesspeople whose inclination would be to cut back employment," he said. "Earned Income Tax Credit doesn’t get anybody to cut back, it gets them to hire more people."

The federal Earned Income Tax Credit reduces taxes for low- and moderate-income working people. About 29 states have passed their own earned-income tax credit. While mayor in 2004, Bloomberg signed legislation starting a local tax credit.

In 2018, Bloomberg again called for using the tax credit rather than raising the minimum wage. During an interview with Christine Lagarde of the International Monetary Fund, he repeated his concern that an increase in the minimum wage would lead to job losses. (The Congressional Budget Office has found far more people would receive wage hikes than likely lose their jobs under a national increase to $15 an hour.)

Bloomberg’s support for the tax credit rather than a rise in the minimum wage is shared by some experts. However, others say the two policies can work in tandem, and both could help poor workers.

While Bloomberg spoke broadly against a minimum wage increase, in 2012 he did support raising the minimum wage in New York to $8.25 an hour. Also, Bloomberg had a mixed record on living-wage proposals to lift wages of certain workers who were employed by entities that had city contracts. When Bloomberg opposed such measures, he raised concerns about the cost for the city or the impact on economic development.

Bloomberg now supports $15 minimum wage

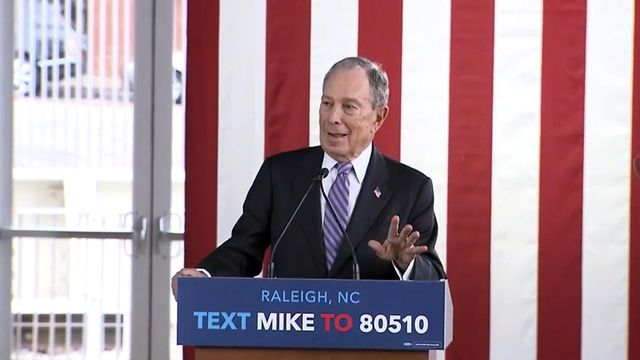

During his 2020 campaign for president, Bloomberg has called for raising the minimum wage to $15 an hour. He also calls for enhancing the tax credit.

Bloomberg’s labor plan says he will sign the Raise the Wage Act, which would raise the minimum wage gradually over six years to $15 an hour. The bill passed the House in July 2019 and has not had a vote in the Senate.

The Bloomberg campaign did not explain the change of position. Bloomberg has not publicly addressed it, as far as we can tell.

PolitiFact ruling

Sanders quoted Bloomberg as saying in 2015 that he had never supported raising the minimum wage.

Bloomberg did make that statement. He called for raising the Earned Income Tax Credit instead.

Bloomberg changed his position in 2020. He now supports raising the federal minimum wage to $15 an hour over six years.

With that clarification, we rate this statement Mostly True.