Fact check: Did Biden's government spending cause inflation?

Jane Timken, a candidate in Ohio’s Republican U.S. Senate primary, casts herself as a "mom on a mission." She seeks to blend a pro-Trump agenda with a focus on kitchen table issues. In a recent ad, she targeted inflation and President Joe Biden’s policies.

"Joe Biden's wasteful spending has sent prices skyrocketing," Timken said in the April 13 ad. "Now, everything from groceries to gas and meals with our families costs more."

The ad shows a headline from an article in the conservative National Review "Inflation soars to four-decade high."

We decided to look at how much of an impact Biden’s spending had on prices.

We reached out to Timken’s office and did not hear back, but this criticism of Biden generally refers to passage of the $1.9 trillion American Rescue Plan.

The March 2021 Democratic bill included $1,400 payments to every American, $360 billion for state and local governments, and $242 billion in expanded unemployment benefits, among other things.

As lawmakers worked on the measure, some economists, including Larry Summers, a top official under President Barack Obama, warned that the bill would lead to inflation. Fiscal conservatives joined in the warning.

"The American Rescue Plan was far larger than the economy could support," said Marc Goldwein with the Committee for a Responsible Federal Budget, a group that promotes lower deficits.

In the months that followed, inflation has taken off in the U.S. In March, prices were 8.5% higher than 12 months earlier. Even filtering out the cost of food and energy, which can rise and fall quickly, inflation still ran at a yearly rate of 6.4%.

How much of this can be put at Biden’s feet? Some, but not all of it, experts say.

"With no American Rescue Plan, we would still have inflation above the Federal Reserve’s target of 2% to 3%," Goldwein said.

The post-COVID-19 inflation story is more complicated than just federal spending. Other forces, including changes in the labor market, rising global energy and commodity prices, supply chain dysfunction and the war in Ukraine have all contributed to higher prices.

Estimating the impact of the American Rescue Plan

No magic formula can reveal precisely how much the American Rescue Plan fueled inflation, but the general consensus is that it was a contributor. Some economists estimate that it added two percentage points to the rate, some say it added up to four percentage points. Put another way, out of the 8.5% rate in March, the measure accounted for something between one quarter to one half of inflation.

Economist Dean Baker, with the left-leaning Center for Economic and Policy Research, puts the number at about two percentage points.

"My main basis for saying this is that other wealthy countries, without remotely comparable stimulus packages, have seen comparable jumps in their inflation rates," Baker said.

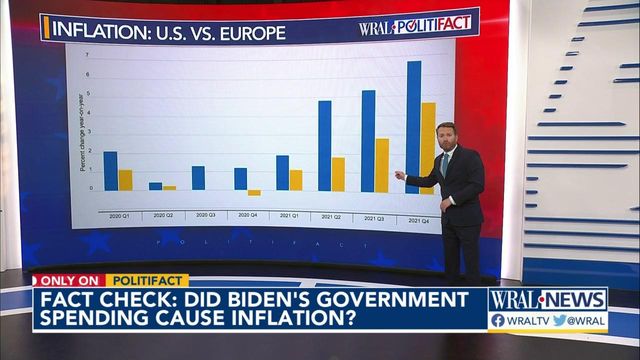

Baker looked at Europe to help tease out the global inflation drivers from the American ones.

Douglas Holtz-Eakin, president of the conservative-leaning American Action Forum, also compared the U.S. with Europe. Between the first and last quarters of 2021, European inflation went up three points. In the same period, U.S. inflation rose more than four points.

Several inflationary forces affected nearly every nation.

COVID cut into the supply of workers and goods. Businesses struggled to find employees. Manufacturers couldn’t get the parts they needed — the shortage of microchips was a prominent example. Both dynamics pushed prices higher.

The resurging economy outstripped the supply of oil and natural gas, leading to higher energy costs. As the pandemic eased, the economic recovery also triggered shortfalls in the supply of grains and other farm products.

"Europe had to deal with the supply-side, the broken supply-chains and the rest," Holtz-Eakin said. "They did not do stimulus to the extent we did, and they still got inflation."

Holtz-Eakin pointed to the moment when the U.S. and Europe parted ways — in the second quarter of 2021. That was right after passage of the American Rescue Plan.

About half of the U.S. increase of four percentage points "you can easily attribute to the stimulus," Holtz Eakin said.

Other economists estimate higher impacts.

Michael Strain with the free-market-oriented American Enterprise Institute put the figure at about three points for 2021. Harvard economist and former Obama administration official Jason Furman said it could be as high as four points in 2022.

Sorting out effects of the war and the pre-Biden spending

Going forward, it’s likely to get harder to tease out the inflationary impact of the American Rescue Plan. Russia’s attack on Ukraine disrupted a world economy that was still sorting itself out after COVID. Sanctions aimed at cutting Russia’s energy revenues sent oil and gas prices soaring. The war’s crippling hit on Ukraine’s agricultural sector, combined with sanctions (Russia is a major wheat producer), has raised the prices of basic goods like wheat and sunflower oil.

Baker says that in ordinary times, with the bulk of the stimulus already spent, the economy would be on its way toward balance.

"However, the special factors of the pandemic and war prevent that," Baker said. "And of course, oil is a big part of the problem."

Another complicating factor is the effect of the spending that came before Biden took office. Two bipartisan COVID-relief packages cost over $3 trillion. Goldwein said it all contributed to inflation, though he thinks the American Rescue Plan added more, because it came as the economy was already springing back. Holtz-Eakin also said that the earlier spending was more in line with the level of economic damage due to the pandemic.

There is concern that companies are profiting from inflation, and fueling it further. Baker said corporate profits are high, but he’s neither surprised by the trend, nor does he see anything conspiratorial at hand.

"The way you ration demand is with higher prices," Baker said. "This might be a good argument for higher corporate taxes, since they have been the big winners, and there clearly are competitiveness problems in many industries, but I don't think that is the story of the current inflation."

PolitiFact ruling

Timken said Biden's spending "has sent prices skyrocketing."

The 2021 American Rescue Plan Act added about $1.9 trillion to the economy, and economists across the political spectrum say that it spurred inflation. They differ on the precise scale of its impact, with estimates ranging from two to four additional points out of the current inflation rate of about 8.5%.

However, none of the experts we reached, liberal and conservative, said Biden’s actions were responsible for all of the inflation. Past government spending, COVID’s disruptions to labor markets, energy prices and supply-chains also played significant roles. Most recently, the war in Ukraine has made a challenging situation worse.

We rate this claim Half True.