Credit card debt is rising, here's how to boost your credit score

Do you want to buy a home or a car? Get a credit card or loan? Your credit score determines if you can and how much you will pay in interest. WRAL 5 On Your Side shares 5 ways to boost your credit score.

US Credit card debt is nearly 1 trillion dollars, which is a record.

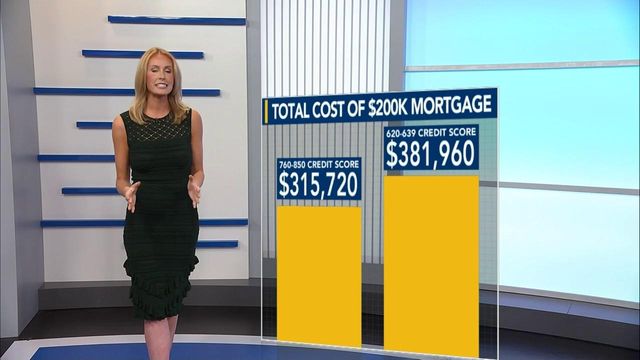

Your credit score determines your creditworthiness, such as your likelihood of paying a loan and getting back on time. For example, someone with a FICO score of 760 to 850 will pay $66,000 less in interest than someone with a score of 620-639 on the same $200,000 mortgage.

Here are 5 ways to boost your score according to www.creditbuildingtips.com:

- Keep your credit utilization low: Use only some of the credit available to you; using under 30 percent of what's available on your cards will boost your score.

- Ask for a higher limit, just don’t spend like you do: this will create more of a contrast in your utilization; which is how much credit you use versus what’s available to you.

- Keep old accounts active: Don't close your account even if you've paid your card off. Use it for small purchases and keep the pay-off balance each month.

- Get credit for paying off uncredited payments, like rent or utilities, by signing up for services like Experian Boost or Extra Credit.

- Finally, check and challenge errors in your credit. Financial institutions are not perfect 100 percent of the time. Request a free credit report and make sure everything listed is correct. If not, write a Credit Challenge Letter to the credit bureau.

Luckily, you don't need a perfect score. Getting your score above 750 can get you lower interest rates or get you better loan terms.