NC utility probe of Duke merger to detail CEO move

Wall Street observers and consumers will be looking for an explanation from the new, surprise CEO of Duke Energy Corp. when he is grilled by North Carolina regulators investigating last week's takeover of Progress Energy Inc.

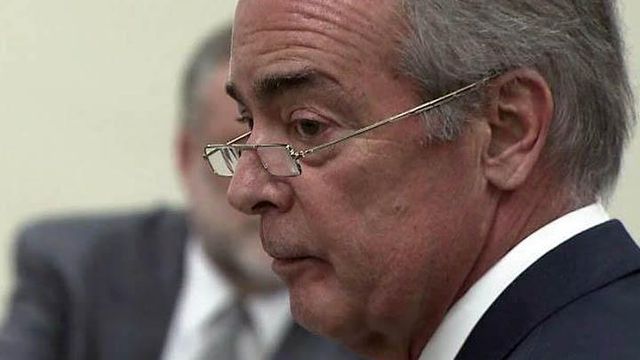

The commission is demanding testimony on Tuesday from Jim Rogers, the Duke CEO who wound up as the top executive of the largest U.S. electric utility.

State law allows the utilities commission to rescind or alter its June 29 decision approving the merger. Duke is based in Charlotte and Progress is based in Raleigh.

Watch coverage of the Utilities Commission hearing LIVE on WRAL.com, starting at 2 p.m. Tuesday.

Duke Energy has refused to explain a last-minute decision by its board of directors to reverse its longstanding plans to name Progress Energy CEO Bill Johnson head of the expanded company. Johnson is due to receive up to almost $44.7 million in severance, pension benefits, deferred compensation and stock awards.

One of the conditions of his separation agreement is that neither he nor the company speak ill of the other, even if they're telling the truth. But legal proceedings are an exception, meaning that Rogers could reveal new details about what happened to sway Duke Energy's board when he testifies on Tuesday.

"Jim will be able to speak more fully" about the move, Duke Energy spokesman Tom Williams said Monday.

Florida media have pointed to ongoing problems at the Crystal River nuclear plant as a possible reason for Johnson's sudden departure. The Progress Energy plant on the Gulf Coast has been out of service since 2009, when reactor walls were damaged during upgrades, and the estimated cost for repairs has reached $2.5 billion.

The utilities commission and North Carolina Attorney General Roy Cooper launched separate investigations after Progress Energy board members said they felt misled about the merger plans.

Rogers' testimony could be important in helping Duke Energy soothe investors' anxiety after the company's share price lost 6 percent in the week after the merger closed, Wall Street analysts said.

A top concern for many investors is that North Carolina regulators could act on their misgivings by responding negatively to rate increase requests by Duke and Progress later this year, Credit Suisse analyst Dan Eggers said in a report to investors Monday. Duke and Progress will continue operating as separate electricity providers. Both operate in parts of North Carolina and South Carolina.

"The question is, therefore, what could happen in the coming rate cases if the commission is in fact upset with the change or feels misled," Eggers said. "A well-supported and reasonable explanation for the board's decision to switch CEOs will end the conspiracy fears in the market and give confidence the Carolinas regulators will not be out to 'get them.'"

Deutsche Bank Securities analyst Jonathan Arnold said one of the main benefits of the merger for Duke Energy is the opportunity to turn a new page with North Carolina regulators, who had given Duke "a challenging time" when considering rate requests.

"Judging by some of the comments from NCUC commissioners, the abrupt change in leadership versus what was laid out in the merger agreement which they approved may have had the opposite effect," Arnold said.

Because Duke Energy plans to retire old electricity power plants and invest in cleaner generation technology, the company will need to ask regulators more frequently for permission to pass along costs to consumers through higher rates, Morningstar analyst Andrew Bischof said.

Johnson, 58, signed a three-year employment contract days before the merger took effect July 2. But hours after the merger closed, the new company announced he had decided to leave by "mutual agreement." Instead, Rogers, 64, is remaining to run the expanded company.

Rogers also is expected to speak to Progress Energy employees in Raleigh later in the week.

The combined company will serve more than 7 million customers in North Carolina, Kentucky, Ohio, Indiana, Florida and South Carolina. Duke Energy's more than $100 billion in assets include power plants in Central America and South America and a portfolio of wind and solar renewable energy projects in the U.S.