Rapidly rising interest rates push home loan applications down 21%

As mortgage rates climb, fewer people can afford to enter the housing market. Right now, applications for home loans are down 21% from one year ago.

Posted — UpdatedLenders admit the Triangle housing market is slowing due to higher mortgage rates.

Even though interest rates have gone up a few percentage points, it’s a huge jump: Potentially hundreds of thousands dollars more in interest for potential buyers and those looking to refinance.

Originally from California, Dave McCulloch moved into a downtown Raleigh apartment with dog Dakota last fall, and they love it.

"It feels like there's a lot more life here than maybe there was even a year ago," he says. "You get to know people. I walk down here all the time and see the same government employees and they’re like, 'Hey, Dakota.'"

He just wishes he had bought instead of rented, at the time.

Interest rates are incredibly high -- at 5.1% and counting.

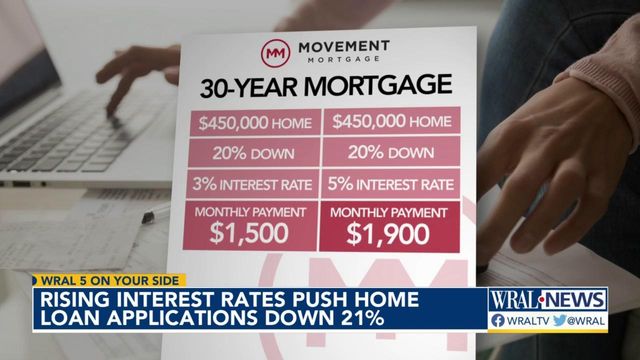

Jon DeHart, a loan officer for Movement Mortgage in Durham, says if you bought a $450,000 home with 20% down at a 3% interest rate earlier this year, your monthly bill before taxes and insurance for a 30-year mortgage would be $1,500. Now, with a 5% interest rate increase, the same priced home with a 30-year mortgage would cost you $1,900 a month.

"So they had about a 25% increase in payment going from a 3%, rate to a 5% rate," he says.

If you want to buy now, having a great credit score can help keep your rate low. You can also find lower rates by locking into a shorter, 15-year mortgage. An adjustable-rate mortgage, known as an ARM, starts at a lower rate; however the rate increases after a few years, which can be risky. It is a good option for people who know they’ll move within that time frame.

"It’s not going to hurt them when they look into an ARM because they won’t be there when the adjustment comes up," he says.

McCulloch hopes to stay in the Triangle long term, but for now that means as a renter.

"I’m just waiting right now. I don’t feel comfortable to make the decision to buy a house right now," he says.

Rates could change again soon. The federal reserve meets next week to set interest rates. While they don’t dictate mortgage rates, it certainly will have an impact.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.