Raleigh family gets insurance for less than penny a day under health law

With the 2015 deadline to enroll for health coverage under the Affordable Care Act approaching, one Raleigh family is spreading the word to get people signed up.

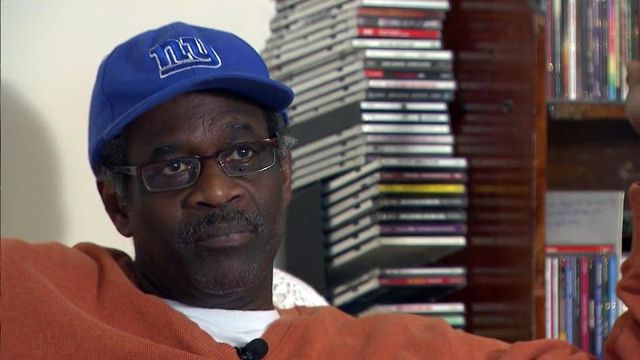

Posted — UpdatedGlenn Jeter used to work at IBM, but he lost his job – and his employer-sponsored health insurance – two years ago.

"As luck would have it, the only time I've ever been hospitalized in my life was after I found myself without insurance," Jeter said.

He developed kidney stones and later suffered a stroke.

"Three days in the hospital to have kidney stones removed and $30,000 in debt – bam, just like that," he said.

With rehabilitation and prescription medicine, Jeter got better and found another job. But the medical bills kept piling up.

"It was scary," he recalls.

Last year, his wife, who stays at home with their special-needs son, started looking into coverage from the federal marketplace at HealthCare.gov.

They found a Coventry Health Care of the Carolinas plan that, with subsidies, cost the family $24 a month.

"Finally, we went and enrolled," he said. "I hate to say it was a godsend, but it has met all of our medical needs and for a much lower cost than what we expected."

The family has already re-enrolled for 2015, and their plan now costs only 24 cents a month.

Although they still have to pay off their debts, Jeter said the coverage helps with prescriptions and doctor visits, and his previous conditions don't affect his ability to have health insurance.

"I don't know how we'd be able to make it without 'Obamacare,'" he said.

More than 458,000 North Carolinians, including 65,000 in the Triangle, have already enrolled for 2015 through HealthCare.gov, and officials say 92 percent have qualified for financial help to lower the cost of their monthly premiums.

The deadline is Feb. 15. Those who don't obtain insurance by then – or who don't have coverage through their employer – face a tax penalty of $325 or 2 percent of annual income, whichever is greater, next year.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.