Raises for state employees, preparations for recession in proposed state budget

Legislative Republicans rolled out their proposed new state budget Tuesday, calling for a small new bump in state employee and teacher salaries.

Posted — UpdatedLegislative Republicans rolled out a restrained new state budget proposal Tuesday, pairing small new raises for teachers and state employees with preparations for an economic recession.

Much of the state’s recent surplus tax collections, due in part to an economy that has outperformed predictions throughout the pandemic, will go to the bottom line, including $1 billion lawmakers want to set aside for an “inflationary reserve.”

They also plan to dip into normal sales tax revenues to bolster transportation spending by hundreds of millions of dollars, an acknowledgment that falling gasoline tax revenues can't cover road construction costs. The proposal would also remake part of downtown Raleigh by tearing down and renovating buildings near the capitol complex and building a new campus for the state’s K-12, university and community college administrations.

Teachers and state employees would generally get an extra 1% salary increase in the budget, on top of the 2.5% they were already scheduled to receive in the coming fiscal year, which begins July 1. Republican budget writers said the average teacher raise, including step increases, would be 4.2%, but total raises will vary by experience, with younger teachers generally seeing larger increases. The proposal also expands a teacher salary supplement in rural counties that would add up to $5,000 to teacher salaries in those counties.

Retired state employees would get another one-time, 1% cost-of-living bonus on top of the 3% already approved for this year. The proposal also has $80 million in a salary reserve allowing state agencies to provide targeted salary increases to attract and retain employees.

There are no new tax cuts in the proposal, despite multibillion-dollar surpluses and weeks of conversations about returning money to the taxpayers. Previously planned cuts in both business and personal income tax rates, which were agreed to last year, will continue, though.

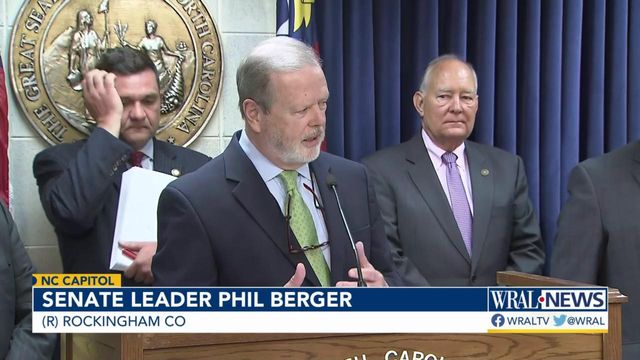

Senate President Pro Tempore Phil Berger called the proposal, backed by the GOP majorities in the House and Senate, “the right budget for North Carolina at this time.” It focuses primarily on adjustments and limited additions to the second year of a two-year budget that lawmakers passed last year, he said, instead of a wholesale rewrite or an endorsement of large new programs.

The proposal has several elements designed to deal with inflation, or with concerns that a recession is on its way. The state’s regular rainy day fund would total $4.75 billion in this budget, but lawmakers also want to create a separate “Stabilization and Inflation Reserve” of $1 billion.

The legislative budget would also expand an education program Cooper has opposed, increasing funding for private school vouchers through the Opportunity Scholarship program by $56 million in the coming fiscal year, taking the total to $176.5 million.

That program would also expand its eligibility, opening to families who make up to 200% of the threshold income for free or reduced price lunches. The current rule is 175%.

Cooper also wants Medicaid expansion. All he would promise Tuesday was to review the legislative budget proposal. Some General Assembly Democrats said they wouldn’t be surprised if the governor vetoed this budget, as he has in past years.

“I think it’s going to be a fight,” House Democratic Leader Robert Reives said.

The State Employees Association of North Carolina called on Cooper to veto the bill, with Executive Director Ardis Watkins saying in a statement that the legislature decided to "hoard money" rather than reward state employees.

"Budgets are always about priorities," Watkins said. "This budget shows state employees and retirees that they are not a priority."

Every teacher would get an increase, but the raises are front-loaded in the pay scale, so that younger teachers see more of the benefit.

Lawmakers also want to add another $70 million to a program they created last year meant to boost local supplements in lower-income counties. The maximum supplement under that program would increase to $5,000 per teacher.

Noncertified school employees, such as custodians and cafeteria workers, would get either a 4% raise or a bump up to $15 an hour, whichever is larger.

The biggest change: A new education campus to house administrators for the University of North Carolina System, Community Colleges System, the Department of Public Instruction and the Department of Commerce.

This budget also contemplates selling the former Department of Motor Vehicles headquarters in downtown Raleigh, and it calls for a new executive headquarters to house the governor’s staff.

Speaker of the House Tim Moore said that, taken together, the moves should be transformative and make up for neglect. “The can was kicked down the road for years and years,” he said.

Lawmakers also set aside $250 million to cover cost increases in already-approved construction projects on an as-needed basis.

The NC Chamber of Commerce praised the idea in a statement, saying the state "must build the modernized transportation funding model we need to keep growing good jobs for the people of North Carolina." The chamber put the impact of these transfers at $193 million in the first year, $410 million in the second year and $628 million in the third year, when the percentage would hit 6%.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.