Durham eyes limits on historic tax breaks in down economy

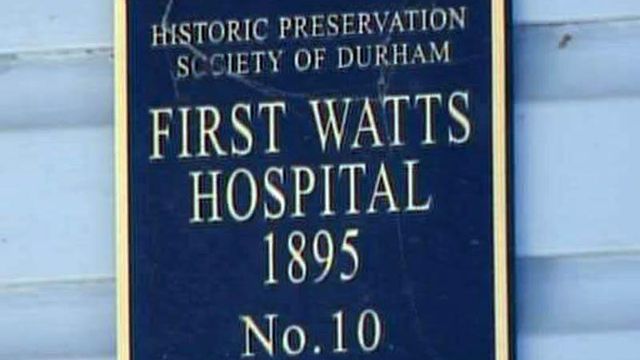

The economic downturn has Durham officials looking at a historic landmarks program to determine how much the city is losing on tax breaks for property owners and whether the rules need to be tightened.

Posted — UpdatedThe economic downturn has Durham officials looking at the landmarks program to determine how much the city is losing on the tax breaks and whether the rules need to be tightened.

"I think there's a little bit of a concern that the criteria may be too broad," Durham Planning Director Steve Medlin said.

Medlin said his staff doesn't have a running total on the tax breaks through the years. Six properties applied for landmark status this year, creating a potential loss of about $40,000 if all were approved, he said.

Under state law, in addition to obtaining local designation as a landmark, property owners must receive a separate approval for the tax break.

Raleigh has between 70 and 80 properties that qualify for tax breaks as landmarks, while Chapel Hill doesn't participate in the program.

John Compton, executive director of Preservation Durham, said historic properties are often more expensive to maintain, and the owners must comply with restrictions on how their properties are developed. So, he says, the tax break is fair.

"It's a very reasonable thing for someone who is giving up that element of control of their property for the benefit of the community," Compton said.

Although Durham is taking another look at the landmarks program, Medlin said he doesn't expect it to go away.

"I think the community as a whole sees the value of the program," he said.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.