Lawmakers eye sales tax on services

With North Carolina staring at a growing budget deficit, some lawmakers have floated the idea of expanding the state sales tax to include many services that have gone untaxed for years.

Posted — UpdatedEasley ordered some state departments to cut their budgets by 5 percent to prepare for the slowdown in tax revenue, up from the 2 percent cuts he ordered in September.

No sales tax is collected on most labor or services in North Carolina, from auto mechanics to barbers to accountants. A few exceptions to the rule include dry cleaning and cable television installation.

Some lawmakers want to revise the tax code so sales tax can be charged on the excluded services, setting up a fight with business owners and fiscally conservative legislators.

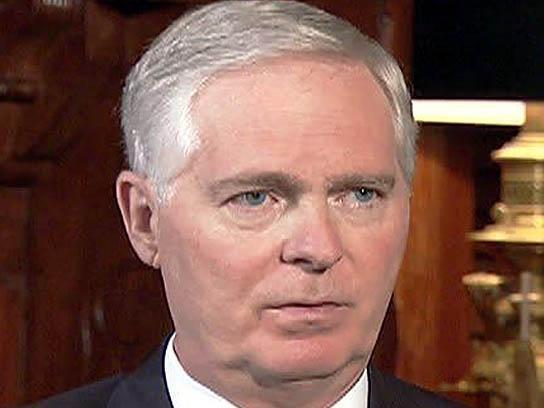

"We do not need, in this economy, to be adding more taxes to hairdressers and other professional services that people buy every day," said Rep. Nelson Dollar, R-Wake.

Tim Schelfe and some of his colleagues already have been through a battle on what North Carolina considers a taxable service.

Schelfe, a past president of the state chapter of the American Society of Interior Designers, said the state Department of Revenue put some of his fellow designers out of business with its interpretation of the tax code.

If designers advise a client how to create a gorgeous living room or hotel lobby, they don't collect sales tax. As soon as they sell a painting, chair or pillow to carry out the plans, the Department of Revenue said the whole package – including the professional advice – is subject to sales tax.

"We thought it was silly. We thought, how could this be happening?" Schelfe said. "We really thought it had to be a mistake. Why would they be doing this, or how could they be doing this?"

State officials determined that one design firm owed almost $200,000 in back taxes, he said.

The designers banded together and battled for two years before state lawmakers agreed to change the tax code last summer and exempt the service from sales tax, even when it accompanies the sale of furnishings.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.