Consumer Advocates Call for More Mortgage Protections

State lawmakers on Wednesday examined the effects of the national mortgage crisis in North Carolina as they consider new regulations to protect homeowners.

Posted — UpdatedAlmost 22,000 homes are in the foreclosure process in North Carolina, placing the state 19th nationwide. Industry observers predict about 60,000 foreclosures statewide this year, which would be a 20 percent jump from 2007.

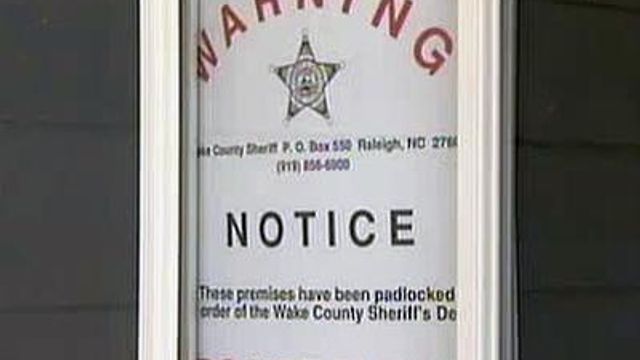

In Wake County, the picture is even worse. Almost 4,000 local homes are in foreclosure already this year, compared with about 4,500 for all of last year.

"It's one thing to say it's not as bad here in North Carolina, but for those 60,000 families who are going through foreclosure in 2008, it's a major problem," Senior Deputy Attorney General Josh Stein told a special legislative committee.

Wanda Brown lost her home several years ago when the mortgage payments piled up.

"They say there's help out there. (But) you go try, and with your credit worse every time you can't pay your mortgage, it doesn't help," Brown said.

Industry observers said North Carolina's strong laws against abusive lending help homeowners. Consumer advocates also called for increased regulation of mortgage lenders and more funding to enforce current laws and provide counseling to at-risk homeowners.

"Not enough is done until we get through this whole process of people to stop losing their homes to these bad loans and predatory lenders," said John Comer, executive director of the advocacy group ACORN, the Association of Community Organizations for Reform Now.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.