N.C. House proposal includes average 5.5% raises for teachers, 5% for other state employees

State House leaders are proposing a package of fairly modest tax cuts, raises and bonuses in their budget plan, weighing in between earlier proposals form Cooper and the state Senate.

Posted — UpdatedThe full House budget document wasn’t available yet Monday afternoon, but House Speaker Tim Moore’s office said it should be posted late Monday afternoon.

The House's proposal for raises is more generous than the Senate's, but less generous than proposed by Gov. Roy Cooper in March.

According to Moore’s office, the House is proposing an average 5.5% raise for teachers over the next 2 years, weighted this time toward veteran teachers, who will now top out at $55,500 a year instead of $52,000.

The teacher raises are higher than the Senate's plan at 3%, but lower than the 10% raise Cooper proposed in his budget recommendations.

The House is calling for a 5% state employee raise over the next 2 years. That’s the same as Cooper’s proposed raise, and higher than the Senate plan, also at 3%.

All three plans include varying bonuses for teachers, non-certified school employees, and other state employees. The House is proposing higher bonuses for workers making less than $75,000 a year, and for those in high-risk front-line jobs.

Retired state employees and teachers would see a one-time bonus of 2% this year and again next year, but no permanent cost of living increase (COLA). They haven’t received a COLA since before the recession of 2009.

The House's plan for cuts is more modest than the Senate's plan.

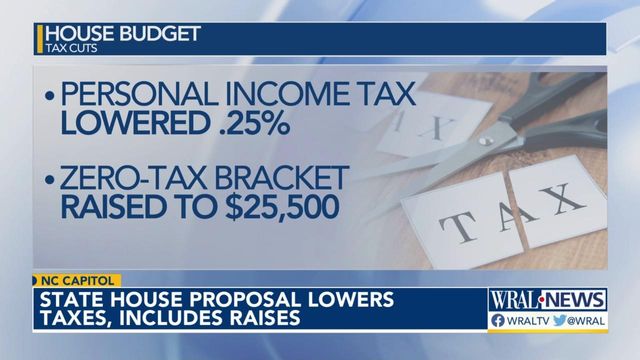

House leaders are proposing to reduce the personal income tax rate from 5.25% to 4.99% starting next tax year. That’s a smaller cut than the Senate's proposal to lower it to 3.99%.

The House plan would reduce the corporate income tax rate from 2.5% to 1.99% by 2025, but would not eliminate it entirely as Senate leaders had proposed.

The House would also increase the standard deduction from $21,500 for a couple filing jointly to $25,500, which is the same as the Senate’s proposal. The change would match an increase at the federal level.

Chairman Rep. John Szoka, R-Cumberland, told the House Finance committee Monday that the proposal will mean lower taxes for almost every family.

"The median family income in North Carolina in 2019 which is the latest data I could find, is $72,047," Szoka said. "By implementing not only the tax reduction, but increasing the zero tax bracket, that will result in that family saving $330 a year. They'll pay $330 a year less in North Carolina state income tax."

Military retirees and their beneficiaries would also no longer have to pay state income taxes on military retirement pay or benefits.

The House bill also includes an earlier House proposal, H334, to allow businesses to deduct expenses that were covered by PPP loans, and to allow people who received unemployment benefits in 2020 to deduct up to $10,200 of that income from state tax liability as long as their adjusted gross income for 2020 was under $150,000.

House leaders also included changes to franchise taxes and other business taxes similar to those in the Senate proposal.

The Senate’s proposal would cost about $13.7 billion in revenue over the next five years. The price tag on the House’s version would be smaller, at $8.6 billion over the next five years.

Governor Roy Cooper did not propose any across-the-board tax cuts in his budget recommendations in the spring, though his spokesman Ford Porter noted that he had proposed targeted relief through the Earned Income Tax Credit and Child and Dependent Care Tax Credit.

The House would put less in savings than the Senate, $2.8 biliion as opposed to $5 billion. Instead, they would put $1.6 billion more than the Senate into the State Capital and Infrastructure Fund (SCIF) over the biennium, with a total investment of $5.8 billion in that fund.

House leaders also want to put about $1.6 billion into water and sewer needs, nearly $1 billion into resiliency and flood mitigation, and a little over $1 billion in federal ARP funds into broadband expansion.

All in all, House leaders say they're investing $9 billion dollars in this budget for aging infrastructure, COVID recovery, and K-12 and UNC construction and repairs needs and parks and recreations.

According to Rep. Dean Arp, R-Union, that's more than four times the money raised by the Connect NC bond in 2016.

"We didn’t need a bond. We had plenty of money to fund the needs we have," said House Speaker Tim Moore at a news conference Monday. "I don’t think we’ve ever spent as much on capital in the history of the state."

Moore said he expects "overwhelming bipartisan support" for the measure in the House, though a statement from House Minority Leader Rep. Robert Reives, D-Chatham, said the proposal "falls short" of its potential.

"We should be empowering educators - not censoring their curricula. We should be investing in our communities - not cutting taxes for big businesses. And we should be using this once-in-a-lifetime financial opportunity to build a North Carolina that works better for everyone," Reives said in a statement, adding that this is just one step in the process, and he looks forward to working with stakeholders moving forward.

House leaders are hoping to finish work on their plan this week. After that, the House, Senate and Governor Cooper will have to negotiate a compromise deal.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.