Losses due to power outage may not be worth filing an insurance claim

On Tuesday, North Carolina Insurance Commissioner Mike Causey asked licensed insurance companies to be economically flexible with consumers who have been affected by the Sandhills power outages.

Posted — UpdatedMost standard homeowners’ insurance policies cover up to $500 in food loss due to certain types of power outages. Check with your agent to know for sure. If your deductible exceeds the cost of the food that spoiled, you won’t be able to file a claim. Even if it does, you still might not want to file one because it will increase your premium.

“There would be an increase in premium over the next several years, essentially, to pay back for that one claim,” explained Turner Walston, an independent insurance agent for McClintock Insurance Agency. “It shows up as a claim like with any other claim. When you try to renew your insurance or you try to switch insurance companies, they will know that you filed a claim whether it’s for $400 or $40,000.”

However, for owners of restaurants or other businesses, it might be worth filing a claim.

“They have much higher limits on their business personal property because that’s how they do business. So, in that case it’s worth filing a claim,” Walston said.

Most restaurants will also have businesses interruption service, which typically kicks in after 24 hours.

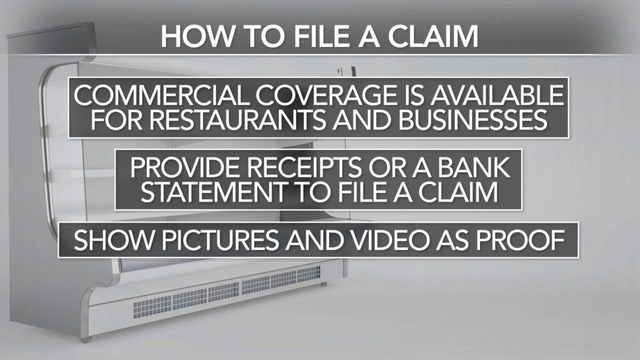

Here are three things you may need to file a claim:

- receipts of the food or medicine purchased

- bank statements if you don’t have receipts

- pictures or videos as proof

It is unlikely that insurance will cover a hotel stay due to a power outage unless there is physical damage to a home. For example, if pipes burst due to a power outage.

On Tuesday, North Carolina Insurance Commissioner Mike Causey asked licensed insurance companies to be economically flexible with consumers who have been affected by the Sandhills power outages.

“This criminal act has had a significant impact on nearly 45,000 residents,” said Causey. “Many folks cannot access their online insurance accounts due to power loss. We are requesting that insurance companies be flexible with customers during this time until power is fully restored.”

In addition, Commissioner Causey has asked the licensed insurance industry to consider the following actions:

- Relax due dates for premium payments.

- Extend grace periods.

- Waive late fees and penalties.

- Consider cancellation or non-renewal of policies only after exhausting other efforts to work with policyholders to continue coverage.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.