Lawmakers may give counties more flexibility on using local sales tax revenue

Counties around the state may soon be asking voters to raise the local sales tax.

Posted — UpdatedThe House overwhelmingly approved a bill that would give counties more flexibility in how an allowed quarter-cent of sales tax is used.

Sales taxes are capped at 7 percent statewide, plus a quarter–cent for transit if county voters approve. The legislation now heading to the Senate would let counties use that extra quarter-cent for school construction, teacher supplements or any other purpose they choose, as long as voters agree to it.

Coastal counties might need funding for beach renourishment, for example, while mountain counties might need it for teacher supplements.

"[This would] allow counties to do what they need to do in terms of projects and things that they know is important, whether it's education or other things," said Rep. Jason Saine, R-Lincoln, a bill co-sponsor. "It gives them more tools to work with, to better manage."

The quarter-cent tax available for public transit has been on the books for more than 20 years, but only Wake, Durham, Orange and Mecklenburg counties have adopted it.

Still, transit advocates were among a handful of House members who voted against the measure Thursday, saying counties shouldn't have to choose between transit and teacher supplements.

But sponsors said the only way they could get enough votes for the bill was by keeping the overall cap at 7.25 percent.

Rep. Howard Hunter III, D-Hertford, said his rural county struggles to pay for schools and services.

"[There are] not many economic opportunities for us," Hunter said. "We have a lot of tourists traveling through Hertford County, Pasquotank County, going to the Outer Banks, and they stop. So, a quarter-cent sales tax works."

Like a lot of rural counties, Hertford County has high property taxes because its tax base is relatively small.

"[We're] evening out the roller-coaster," Saine said. "Not just depending on one source or another can allow you to develop more economically and do more with that."

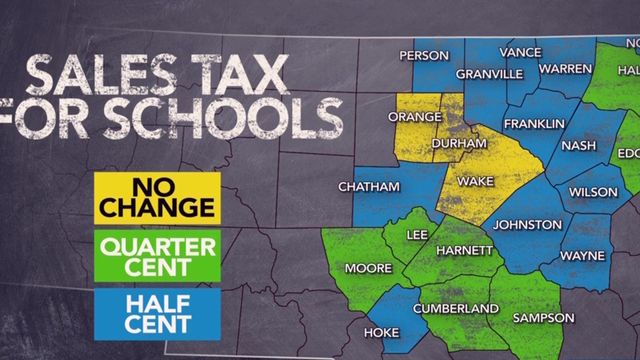

The change wouldn't affect Wake, Durham or Orange counties because of their existing transit taxes. But seven nearby counties, including Cumberland County, would be able to ask voters for another quarter-cent for education or other purposes.

Another 12 counties in central North Carolina, including Johnston, Franklin, Nash and Wayne counties, could seek up to a half-cent increase if their residents approve.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.