Fact check: Is Biden's student loan forgiveness plan a 'bailout for rich kids?'

A television ad by the American Action Network, a conservative, nonprofit advocacy organization, instructs viewers to "tell Congress, stop Biden's bailout for rich kids." PolitiFact checks that description.

Posted — UpdatedA TV ad trolled President Joe Biden by using actors to portray blue-collar workers who, insincerely, sang the praises of his student loan debt forgiveness plan.

"Biden’s plan to pay other people’s college loans using my tax dollars is a great idea," a waitress says with mock enthusiasm.

"Want to be a struggling artist?" a mechanic says. "College is on me."

The ad, which was posted to YouTube Aug. 26, ends with a narrator repeating words that appear on the screen:

"Tell Congress, stop Biden’s bailout for rich kids."

The Republican National Committee and several GOP lawmakers have echoed the sentiment that Biden’s plan serves the rich at the expense of the working class.

Some borrowers who have incomes well above the median household income in America do qualify for Biden’s debt relief.

But the vast majority of the relief is concentrated on borrowers with lower incomes, according to independent estimates.

Who the plan covers

Under Biden’s plan, $10,000 of federal student loan debt will be waived for individuals earning less than $125,000 per year or for couples earning less than $250,000; an additional $10,000 will be waived for people falling under those income thresholds who have also received Pell Grants, which serve low-income Americans.

Meanwhile, there are questions about whether Biden’s plan would hold up in court.

Some beneficiaries arguably are "rich"

The minute-long attack ad is from American Action Network, a conservative, nonprofit advocacy organization whose leadership includes former elected officials who are Republicans.

The income caps in Biden’s plan make borrowers with incomes well above the median eligible for relief. But that doesn’t make it a bailout of the rich.

Most debt relief to bottom 60%

Two independent estimates show student debt forgiveness mostly impacts on people with lower incomes.

The assessment estimates that 4.7% of the relief will go to households earning between $141,096 and $212,209; just less than 1% will go to those earning between $212,209 and $321,699.

Student debt expert Mark Kantrowitz, publisher of SavingForCollege.com, told PolitiFact that with the Biden plan’s focus on Pell Grant recipients, most of the people eligible for the debt relief are from lower-income families.

He estimated that, based on the latest federal figures available, 94% of undergraduate students who received a Pell Grant in 2015-16 had an annual family adjusted gross income of less than $60,000.

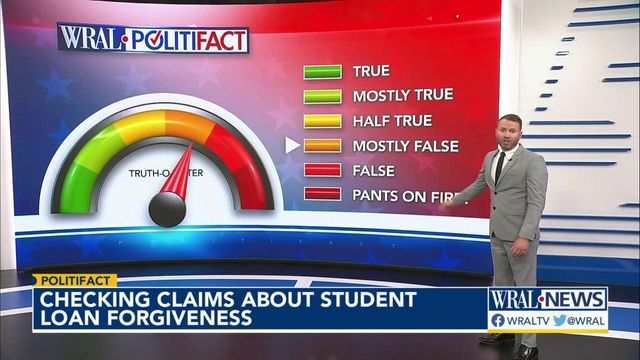

PolitiFact ruling

American Action Network claimed that Biden's student debt forgiveness plan is a "bailout for rich kids."

Some borrowers with incomes well above that of the median American household qualify for the debt relief.

But the vast majority of student loan forgiveness will go to people on the lower end of the income scale. By one independent estimate, 75% of the debt relief will go to households in the bottom 60% by income.

The claim contains an element of truth but ignores critical facts that would give a different impression — our definition of Mostly False.

Related Topics

Copyright 2024 Politifact. All rights reserved.