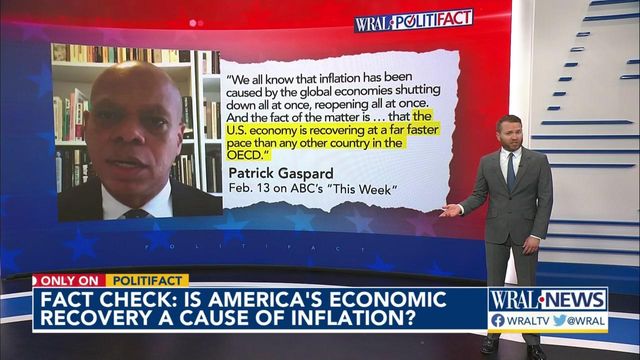

Fact check: Has the economic recovery affected inflation in the U.S.?

During a Feb. 13 roundtable discussion on ABC's "This Week," panelists addressed Americans' concerns about inflation. Patrick Gaspard -- who served in President Barack Obama's administration and is now president and CEO of the Center for American Progress, a liberal think tank -- blamed the coronavirus pandemic for inflation. PolitiFact checks his claim.

Posted — UpdatedAmericans are facing conflicting signals on the economy. The economy is growing rapidly, unemployment is low, and wages are rising. But inflation — a broad pattern of rising consumer prices — is at a four-decade high, and for many voters, that fact seems to be crowding out any other economic news.

"We all know that inflation has been caused by the global economies shutting down all at once, reopening all at once," Gaspard said. "And the fact of the matter is … that the U.S. economy is recovering at a far faster pace than any other country in the OECD. That is an absolute fact." (The OECD is the Organization for Economic Co-operation and Development, a group of 38 advanced, industrialized nations.)

A look at cross-national data shows that economic growth in the United States has indeed outpaced that of the other large, comparable economies, and experts agree that this rapid growth has been a factor in the United States’ currently high inflation rate.

But rapid economic growth is not the only reason why the U.S. is experiencing high inflation.

The other six nations in the G-7 — Canada, France, Germany, Italy, Japan and the United Kingdom — all had yet to reach the GDP levels they had in the fourth quarter of 2019. (Gross domestic product is the sum of all economic activity in a country and is often used as the primary metric for economic growth.)

This supports Gaspard’s comment on "This Week."

Other calculations further back up his assertion about robust U.S. growth. If you strip the inflation adjustment from GDP growth, to enable a cleaner comparison of GDP to inflation, the United States’ GDP growth ranked fifth among the nations that belong to the Group of 20 (a wider group of large economies than the G-7). In this measurement, the U.S. trailed only Turkey, India, China and South Korea. Notably, the United States’ growth rate exceeded that of each of its fellow G-7 members, whose economies are most similar to that of the U.S.

There is also something to Gaspard’s contention that rapid economic growth and inflation are connected.

When we looked at the latest annual inflation rates for the G-7 nations, we found that the U.S. had the highest inflation.

However, the correlation between rapid growth and high inflation isn’t perfect. Germany and Canada had the second- and third-highest inflation rates, respectively, but their economic growth barely edged into positive territory when factoring in the pandemic. And the United Kingdom and France nearly matched the U.S.’s GDP growth rates but have experienced more modest inflation.

Overall, Gaspard’s focus on rapid GDP growth as a driver of inflation is reasonable, experts said — but they added that the causes of inflation are more complicated.

"The current inflation is not monocausal or easily understood," said James Feyrer, a Dartmouth College economist.

Ferretti said that "some global factors affecting inflation are clearly at play, including higher energy prices and disruption of supply chains." Lower rates of labor force participation in the U.S., stemming heavily from pandemic factors such as a shortage of child care options, also played a role.

In fact, one of the factors driving rapid growth in the U.S. — generous fiscal support from the federal government — is something that Biden did have control over. Stimulus payments and other financial support from the federal government put more money into Americans’ hands, driving up demand for goods amid international supply-chain challenges driven by the pandemic.

"Many countries adopted expansionary policies, but on the fiscal side, the U.S. really stands out," Ferretti said. "With very large support to private incomes, U.S. consumption has been very strong, particularly for goods. This has clearly helped the speed of the recovery."

But a combination of strong demand and labor shortages, he said, has resulted in "higher inflationary pressures than in other advanced economies."

In other words, where inflation is concerned, Biden isn’t entirely a victim of global forces. His policies were a factor as well.

PolitiFact ruling

Gaspard said that "inflation has been caused by the global economies shutting down all at once, reopening all at once. And … the U.S. economy is recovering at a far faster pace than any other country in the OECD."

The U.S. has experienced faster economic growth than most of its most direct global competitors, and experts agree that this has contributed to inflationary pressures.

While many of these inflationary pressures are traceable to global factors related to the pandemic, some have flowed from the fiscal choices made by the Biden administration.

We rate the statement Mostly True.

Related Topics

Copyright 2024 Politifact. All rights reserved.