Fact check: Do top universities have billion dollar untaxed endowments?

"Harvard is sitting on top of a $54 BILLION hedge fund they call an 'endowment' that they pay zero taxes on," tweeted Charlie Kirk, the founder of the conservative nonprofit Turning Point USA. PolitiFact checks his claim.

Posted — UpdatedMillions of Americans expressed relief when President Joe Biden announced a long-awaited plan to forgive thousands of dollars in student loan debt.

But not everyone was pleased. Some people used the occasion to spotlight academic institutions — especially those with large endowments — as needlessly untapped sources of funds.

"Harvard is sitting on top of a $54 BILLION hedge fund they call an ‘endowment’ that they pay zero taxes on," tweeted Charlie Kirk, the founder of the conservative nonprofit Turning Point USA. "Yale has $31 Billion. Stanford $29 Billion. Princeton $26 Billion. ‘Elite’ schools sit on a goldmine but the middle class will foot the bill for student loan forgiveness."

An endowment is a group of donation-supported investments a college or university uses as a source of long-term funding. There is debate about how much institutions with very large endowments should spend, but some legal requirements dictate how endowment payouts can be used.

The numbers Kirk cited are in the ballpark. But his tweet oversells the liquidity and versatility of these endowments. They are not cash reserves that schools can draw on without restriction. The tweet also misleads about taxation — the largest of these endowments have been taxed by the federal government since a 2017 law went into effect, though the institutions themselves opposed it.

Some universities have very large endowments

Some universities, including the ones Kirk listed, have endowments valued at several billion dollars.

In 2021, universities reported endowments valued at:

- $53.2 billion for Harvard University;

- $42.3 billion for Yale University;

- $37.8 billion for Stanford University;

- and $37.7 billion for Princeton University.

Kirk’s numbers appear to reflect reported values in 2020, when Yale’s endowment was about $31.2 billion, Stanford’s was $28.9 billion and Princeton’s was $26.6 billion.

Andrew Kolvet, a Kirk spokesperson, said private equity tends to perform better than the stock market, so it’s possible Harvard’s endowment could now exceed $54 billion.

Harvard attributed significant endowment returns in 2021 to private and public equity markets.

Calling an endowment a ‘hedge fund’ is a misnomer

Hedge funds pool investors’ money and invest it in an effort to earn a positive return, according to the Securities and Exchange Commission.

An endowment is a pool of donated funds meant to be invested to maximize returns, but its purpose is more specific: An endowment’s returns are meant to support education at the institution in perpetuity.

Each year, endowment investments accrue returns that are used one of two ways. Some are retained in the endowment so it will continue to grow and support the university in the future. Some are used to support the institution’s budget.

Universities use endowment distributions to support professorships, financial aid for undergraduates, academic programs, libraries, art museums and other facilities and activities.

A percentage of an endowment’s annual payouts are subject to donor-imposed restrictions that require money to support specific programs, departments or purposes. These restrictions limit an institution's ability to access and spend endowment distributions.

Managers of larger nonprofit endowments typically invest in more private equity and venture capital, said Liz Clark, the association’s vice president for policy and research.

Larger endowments also allocate more funds to marketable alternatives such as hedge funds, she said. The research shows that institutions with endowments over $1 billion are more likely to allocate a higher proportion of their investments to those marketable alternatives.

In 2021, Harvard reported that 33% of its assets were invested in hedge funds, for example.

Still, a person who invests in a mutual fund is not a mutual fund. The same is true of endowments, said Sandy Baum, a senior fellow on education data and policy at the Urban Institute, a nonprofit research group.

Institutions want to maximize returns on their endowment, "but the purpose of the endowment is to fund the education of current and future students at the institution," Baum said.

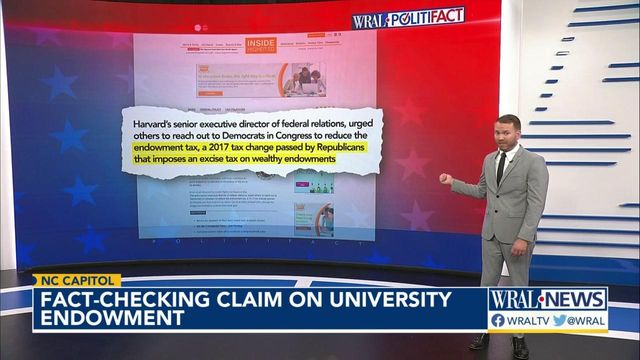

Endowment investment returns are taxed

Kirk’s assertion that these funds are not taxed is wrong. Since a 2017 change in law, some private colleges and universities have seen their endowments’ investment return income subjected to a 1.4% excise tax.

In 2019, Harvard University faced a $50 million total federal tax bill, with about $37.7 million of that amount stemming from the endowment tax. The university’s operating budget that year was about $5.4 billion.

Stanford University said it faced a tax bill of about $43 million for fiscal year 2019 because of the new tax. The school’s operating budget was $6.8 billion.

Federal tax revenue goes directly to the U.S. Treasury when collected; most federal spending comes from general Treasury funds, Clark said.

PolitiFact ruling

Kirk tweeted, "Harvard is sitting on top of a $54 billion hedge fund they call an ‘Endowment’ that they pay zero taxes on. Yale has $31 Billion. Stanford $29 Billion. Princeton $26 Billion."

Kirk was in the ballpark about the size of these endowments, though his numbers might be slightly outdated; the most recent numbers show they’re even bigger. But calling such an endowment a "hedge fund" is a misnomer. Endowment funds are often partially invested in hedge funds to maximize returns, but they are not hedge funds themselves. His claim that these large endowments are entirely untaxed is wrong: Institutions like those he cited in the tweet have been paying a modest but real 1.4% excise tax on their investment returns since a 2017 change in tax law.

We rate this claim Half True.

Related Topics

Copyright 2024 Politifact. All rights reserved.