Fact check: Ad says Beasley wants to raise taxes on people making $75,000

In the television ad commissioned by the Senate Leadership Fund, a Republican-backed political action committee, a narrator says Cheri Beasley "backs tax hikes -- even on families making under $75,000.' PolitiFact checks that claim.

Posted — UpdatedA new ad accuses Democratic U.S. Senate candidate Cheri Beasley of wanting to bail out the rich and tax lower- to middle-income families.

Beasley, a former North Carolina Supreme Court chief justice, faces Republican U.S. Rep. Ted Budd in North Carolina’s race to replace retiring Republican Sen. Richard Burr. The contest is expected to be among the nation’s closest Senate races.

In the television ad commissioned by the Senate Leadership Fund, a Republican-backed political action committee, a narrator says:

“It's a question of fairness. Should a waitress be forced to help pay for a doctor’s student loans? Cheri Beasley thinks so. She backs student loan bailouts for the rich — even couples earning a quarter million dollars a year. Who pays? The rest of us. Beasley backs tax hikes — even on families making under $75,000. Cheri Beasley bails out the wealthy and taxes the rest of us.”

But did Beasley really express support for raising taxes on families making less than $75,000 a year?

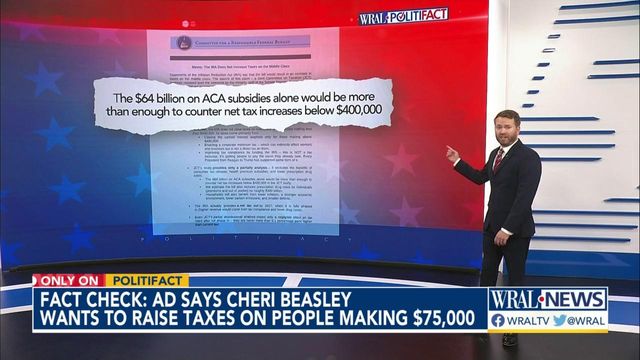

No. The narrator’s transition from student loan bailouts to tax hikes might make it seem like Biden’s debt relief plan is funded by tax increases. That’s not the case. Small on-screen citations signal the advertiser has shifted topics from Biden’s student bailout plan to Beasley’s support for the Inflation Reduction Act.

The Inflation Reduction Act, though, does not change federal income tax rates for people earning less than $75,000 a year. The legislation may indirectly affect lower-income taxpayers to the tune of less than 1% of their after-tax income — but not through direct taxes. And expert predictions vary on when or how that would happen.

Backing ‘tax hikes’

Beasley has expressed support for the Inflation Reduction Act, tweeting on Aug. 7 that it would help lower costs and that votes against the legislation were “inexcusable.”

The bill, which Biden signed into law in August, only directly levies tax increases on very large corporations and high-earning money managers. Any impact on middle-income taxpayers would be indirect and hard to calculate. Corporations tend to pass along the cost of tax increases through lower returns for investors or lower wages for workers.

The bill could cost taxpayers about 1% of their annual income, the committee’s analysis found.

Households making $75,000 or less would lose 0.5% of their gross income as a result of increased corporate taxes passed on to consumers, or about $350 for someone earning $75,000, the committee found.

Several groups weighed-in on the bill’s indirect effect on taxpayers, at varying depths and with varying results.

“After-tax incomes are up by 0.3% on average in 2023 and 0.2% in 2032, and in the long-run they fall by 0.2% after taking into account the economic impacts,” said Garrett Watson, senior policy analyst and modeling manager at the foundation.

Our ruling

The ad says Cheri Beasley “backs tax hikes — even for families making under $75,000” and referenced the Inflation Reduction Act.

Beasley does support the Inflation Reduction Act but the claim is wrong to suggest it includes a change in tax rates for that income bracket. Expert analyses show that any effect on those earners would be on the scale of $350 and, by one estimate, delayed for several years.

The claim has a kernel of truth but ignores critical facts that would give a different impression. We rate it Mostly False.

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.