Credit score apps: Yay or nay?

Credit scores are used for everything from getting a mortgage to getting a job.

Posted — UpdatedIt only makes sense to know what yours is, but as 5 On Your Side’s Monica Laliberte reports, credit score apps may not give you what you think you’re getting.

We’re talking apps through companies including Credit Karma, Experian Credit Report, and others.

They promise your credit score in an instant, some even offer score monitoring.

It all sounds good, but dig a little deeper and Consumer Reports says while the apps have a few upsides, all have significant drawbacks.

“Our investigation showed that the apps can pose serious privacy risks, and what’s worse, our survey of consumers who have used them revealed that in some cases they didn’t even provide an accurate credit score,” said Lisa Gill with Consumer Reports. “Several of the apps use the VantageScore 3.0, which really has limited value because many lenders don’t use it.”

As for privacy, CR says the apps collect and share more data about you than needed for the job, mainly so they can sell you other products and services.

Four of the five apps CR looked into charged users for their credit report, something you can get for free.

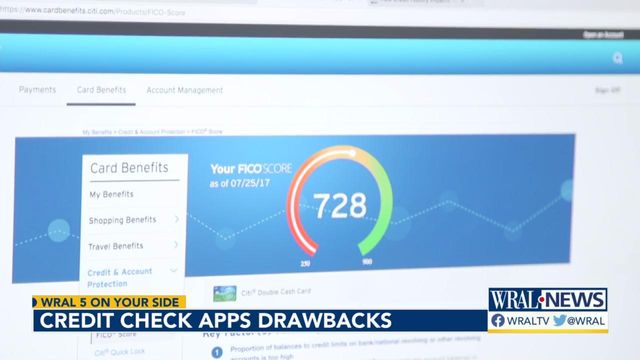

Right now, there’s not similar access to your credit score, but you might be bale to get it through your bank or a credit card company.

Consumer Reports is pushing for free access.

There’s a bill in Congress, but so far, it hasn’t been scheduled for a vote.

CR also asked all five credit app companies about their consumer privacy, data collection, and data sharing practices.

Each responded, saying they take consumer privacy very seriously and that consumer trust is paramount to their business.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.