Fact check: Budd says 91% of stimulus 'is not even COVID-related'

In a speech on the floor of the U.S. House, Rep. Ted Budd said there's about 9% of (the American Rescue Plan) actually going to COVID, meaning 91% of it is not even COVID-related." PolitiFact North Carolina checks his claim.

Posted — UpdatedA North Carolina congressman claims the Democrats’ proposed stimulus plan has very little to do with the coronavirus.

“There’s about 9% of it actually going to COVID, meaning 91% of it is not even COVID-related,” Republican. Rep. Ted Budd said in a speech, which he tweeted.

Is Budd right about those percentages?

The first part of Budd’s quote is accurate. Expert analysis shows a small percentage of the spending is directed at combating the virus through vaccines, protective equipment or resources for health care providers.

But that doesn’t mean the rest of the bill isn’t related to COVID-19. A significant percentage of the bill aims to address the financial fallout caused by the pandemic.

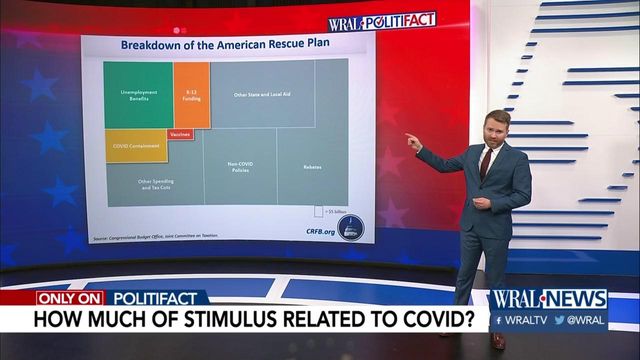

Experts we spoke with put the bill’s spending into three categories: coronavirus containment, things that are tightly or loosely related to the pandemic, and things that shouldn’t be considered related at all.

Let’s look first at spending that directly targets COVID-containment. Depending on how COVID-containment is measured, the cost ranges between $100 billion and $160 billion.

That means the first part of Budd’s claim is nearly spot-on.

What’s COVID-related?

But the second part of his claim is off-base. While a lot of the proposed spending doesn’t directly go toward combating COVID, that doesn’t mean it’s not related to the coronavirus.

A significant portion is designed to offer economic relief to businesses and people affected by the pandemic.

Perhaps the most famous part of the plan, direct stimulus payments to individuals, is estimated to cost more than $420 billion. The plan would also extend unemployment benefits and offer financial aid to help schools reopen.

Erica York at the Tax Foundation and Stan Veuger at the American Enterprise Institute both described economic relief efforts as “COVID-related.”

“Whether you think they’re wise or not, they’re clearly a response to the economic crisis,” Veuger said in a phone interview.

The CRFB reported that $130 billion, or 7%, would go toward helping schools reopen safely.

Less COVID-related

To be clear, the bill does include proposals that experts don’t necessarily see as pertinent.

“The Democratic proposal is going beyond what we’ve seen in past relief measures by significantly expanding existing tax credits and making changes to the international tax system,” York said.

“For instance, lawmakers are proposing expanding the child tax credit,” she said. “Opponents might argue that’s wish list and isn’t a speedy form of relief, but proponents might argue it’s COVID-related because the pandemic and downturn have disproportionately affected lower-income households and so policies are being targeted toward the affected populations.”

Our ruling

Budd said about 9% of Biden’s stimulus plan “is actually going to COVID, meaning 91% of it is not even COVID-related.”

In the first part of his statement, Budd accurately describes the proposed spending on efforts to combat the virus itself.

However, he’s wrong to suggest the rest of the bill isn’t related to COVID-19 at all. He may disagree with how much the bill would spend on unemployment insurance and other financial relief efforts. But the bill does aim to address the financial cost of the pandemic.

His statement is partially accurate but leaves out important details. We rate it Half True.

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.