Duke pays ex-Progress CEO Johnson $10M in severance

Duke Energy will pay Bill Johnson some $10 million as part of a severance package after he resigned as CEO of the combined Duke Energy-Progress Energy after just a few hours in the job.

Posted — UpdatedIn a filing with the Securities and Exchange Commission on Tuesday, Charlotte-based Duke Power said Johnson would receive the "severance benefits" after a tumultuous span of less than 24 hours in which Duke and Progress formally closed their merger then disclosed Johnson's unexpected departure.

Johnson receives:

- $7.425 million, the equivalent of three years salary

- $1.375 million, the equivalent of a one year cash bonus

- $1.5 million in a "parachute" payment

The deal forming the nation's largest utility firm, valued at $32 billion, closed Monday afternoon and Johnson assumed the CEO role while Duke Chairman and CEO Jim Rogers became the chairman. A new board was seated, including 18 members, seven of which were determined by Progress Energy. Johnson was among them.

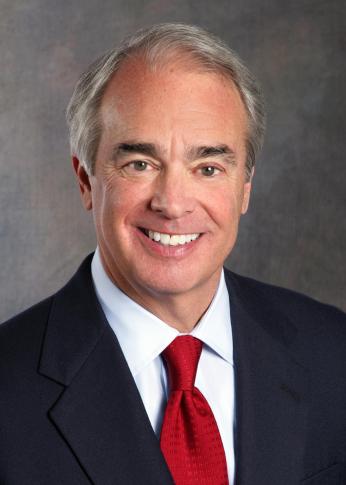

But overnight, Johnson, 58, gave up his new job.

Duke announced the change in a press release early Tuesday, setting off a frenzied day of news reports, company executives talking with employees in Raleigh and Charlotte, and Rogers dealing with Wall Street analysts who had a host of questions about the sudden change. Other than a few general comments, Duke remained mum about Johnson's departure as did Johnson.

What Duke did make available in the SEC filing were the details of Johnson's termination benefits. He had led Progress as CEO since October 2007.

Duke noted that Johnson signed a three-year employment agreement with the company on June 27 as the merger neared formal approval.

"William D. Johnson (the 'Johnson Employment Agreement') that provided for his employment as Duke Energy’s President and Chief Executive Officer and President, effective as of the closing of the Merger on July 2, 2012. The Johnson Employment Agreement was based on the terms set forth on the term sheet by and among Duke Energy, Merger Sub and Mr. Johnson that was executed at the time that the Merger Agreement was entered into," the filing reads.

"The Johnson Employment Agreement provided for an annual base salary of $1,100,000, an annual short-term target bonus opportunity equal to 125% of his then current annual base salary and an annual long-term target opportunity of 500% of his then current annual base salary.

"Upon a termination of Mr. Johnson’s employment by Duke Energy without cause or by Mr. Johnson for good reason, following the closing of the Merger but prior to the second anniversary of such closing, the Johnson Employment Agreement provided for (upon execution of a release of claims) severance benefits that are substantially the same as those provided under the Progress Management Change-in-Control Plan (the “CIC Plan”), except that he would not be entitled to an excise tax gross-up relating to Section 280G of the Internal Revenue Code, as amended (the “Code”). The CIC Plan provided Mr. Johnson, upon a qualifying termination of employment, with three times the sum of his annual base salary and target annual cash bonus, the cost of up to three years of continued benefits, 100% of his target annual cash bonus opportunity for the year in which the termination occurred and vesting of all unvested equity awards outstanding prior to the termination (with all performance shares held by Mr. Johnson vesting at “target level” of performance).

"As a condition to entering into the Johnson Employment Agreement, Mr. Johnson agreed to waive certain rights with respect to good reason under the CIC Plan and to constructive termination under his then current employment agreement with Progress Energy."

"In connection with Mr. Johnson’s resignation, on the Effective Date, Mr. Johnson and Duke Energy entered into a separation and settlement agreement (the 'Separation Agreement). Pursuant to the terms of the Separation Agreement, in consideration for a release of claims from Mr. Johnson, his agreement to cooperate with Duke Energy with respect to transition matters and Mr. Johnson’s agreement to non-competition, non-solicitation, non-disparagement and confidentiality covenants, Mr. Johnson will be entitled to the benefits to be provided upon a resignation of employment for 'good reason' pursuant to the Johnson Employment Agreement, described above under the heading “Employment Agreement with William D. Johnson,” including a cash severance payment of $7,425,000, which is equal to three times the sum of Mr. Johnson’s annual base salary and target annual cash bonus as of the Effective Date, a cash payment of $1,375,000, representing Mr. Johnson’s target annual cash bonus for 2012, measured as of the Effective Date, continued health and welfare benefits, reimbursement for relocation expenses and accelerated vesting of all his equity compensation awards.

"In addition, in consideration of the various covenants identified above, Mr. Johnson is eligible to receive a lump sum payment equal to the lesser of (i) $1.5 million or (ii) the portion of the $1.5 million that, when aggregated with the other payments that are contingent upon a change in control, would not be an 'excess parachute payment' within the meaning of Section 280G of the Code.

"In the event that Mr. Johnson is not entitled to any payments under the preceding sentence, Duke Energy will make a $500,000 payment to Mr. Johnson and, to the extent any payment under the Separation Agreement would constitute an “excess parachute payment” and result in an excise tax under the golden parachute tax rules, Duke Energy would provide a payment to place Mr. Johnson in the same position as if no excise tax had been triggered in accordance with the terms of the CIC Plan. In addition, Mr. Johnson will be entitled to his accrued and unpaid benefits under Progress Energy’s retirement and deferred compensation plans. These benefits were earned during Mr. Johnson’s employment with Progress Energy and will not be enhanced or increased as a result of the Separation Agreement, but will be paid according to the terms of the applicable plan or arrangement based on Mr. Johnson’s service and compensation prior to his resignation."

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.