5 On Your Side

Tips for raising your credit score

If a person’s credit score isn't what it should be, it can be improved – but the key is to start now.

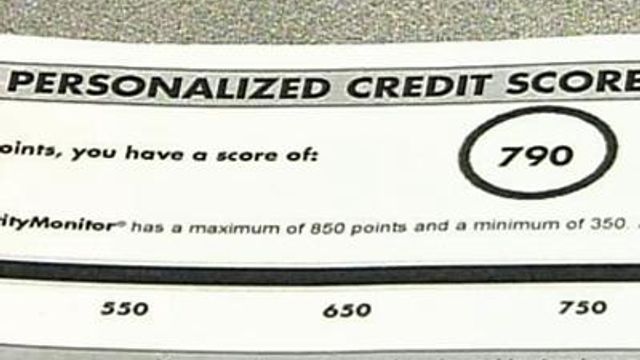

Posted — UpdatedRALEIGH, N.C. — Credit scores give potential creditors an idea of the likelihood of a person paying off a debt and the timeliness of those payments.

“It's the three-digit number that gives you sort of a snapshot in time of how a person has been handling credit,” certified consumer credit counselor Rebekah O’Connell said.

O’Connell said a good credit score can help a person get things like easier access to credit, lower interest rates and more.

“It affects your insurance rates. It may get you a better job,” O’Connell said.

If a person’s credit score isn’t what it should be, it can be improved, but the key is to start now. There is no instant fix for low credit scores, but over time, people can raise their scores.

First, O’Connell recommends getting copies of your credit reports and fixing errors. This should be done at least six months before a major purchase.

It is also important to pay bills on time. “Late payments drop your score like a rock,” O’Connell said. She warned that 35 percent of the credit score is based on whether a person pays on time.

Reducing credit card balances by living within your means can also do a lot to help bring up your credit score.

“Being maxed out or right up to the limit on your credit balances hurts your score. In general, you want to be under 30 percent of your available credit,” O’Connell said.

Keeping older accounts can also raise a person’s credit score by showing a history of how a person has used credit. Closing unused accounts right before applying for a loan can hurt a person’s credit score because the person will owe the same amount of money, but have less total credit available.

Finally, O’Connell recommends not opening new accounts.

“Multiple new accounts opened in a short span of time put you at greater risk of not being able to pay back these loans, therefore your credit score reflects that you might be at greater risk because of these new accounts,” O’Connell said.

The three-digit credit score can pack a lot of financial punch.

“It's wide-ranging. A lot of people are checking credit reports and credit scores,” O’Connell said.

A few things that do not impact a credit score are race, marital status, age, occupation and salary.

How to get your credit report

Each consumer is entitled to one free report per year from each of the three credit-reporting companies.

AnnualCreditReport.com is the only way to get a truly free credit report regardless of what some advertisements say. Going through that Web site allows you to choose which agency to get your free credit report from:

Experian – 888-397-3742

TransUnion – 800-916-8800

Equifax – 800-685-1111

After your one free report per year, credit scores are not free. Each credit reporting company also has its own score.

The best advice is to alternate agencies every four months.

Correcting errors

- A dispute must be done in writing

- Include copies of relevant paperwork along with a copy of the credit report with the disputed item circled

- The reporting agency has 30 days to investigate

- If you ask, credit reporting agencies must send correction notices to anyone who received your report from them in the past six months.

- Dispute the item with the creditor, too

Credit scores are based on

- 35 percent - payment history

- 30 percent - amounts owed

- 15 percent - length of credit history

- 10 percent - new credit

- 10 percent - types of credit in use

Credit experts answered your questions on Oct. 1, 2008.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.