Senate sales tax plan seeks to end 'unfair advantage' for urban counties

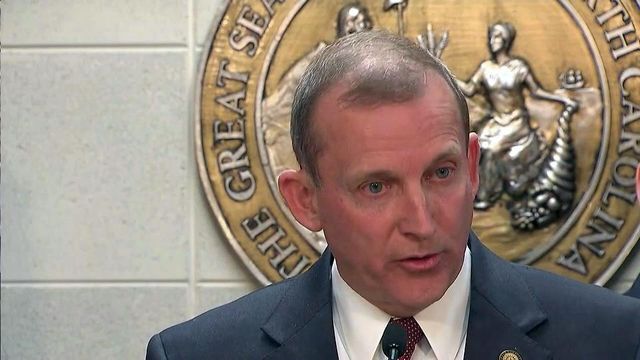

Key members of Senate leadership rolled out a plan Monday to overhaul how state sales taxes are distributed, which they say will lead to a fairer system across North Carolina.

Currently, 75 cents of every $1 raised by the 2 percent local portion of the sales tax stays in the county where a sale is made, with the remaining quarter distributed on a per-capita basis statewide. Legislation filed Monday night – a companion bill is planned in the House – would shift that over the next three years so all local sales tax revenue is distributed per capita.

The state's 4.75 percent portion of the sales tax and local levies, such as the half-cent transit taxes imposed in Durham and Orange counties, wouldn't be affected by the proposal.

"We're talking about a system that been in place for a long, long time that I think is outdated and really has divided the state into two North Carolinas," Senate Majority Leader Harry Brown said. "Reforming our state's sales tax system will help ensure that all North Carolina counties benefit from tax dollars their own citizens pay so they have the local resources necessary to strengthen public education, attract new jobs and contribute to our state's economy."

Brown, R-Onslow, said the system is rigged to benefit urban counties with shopping malls and commercial centers at the expense of rural areas. For example, he said, Wake County received $145 million in sales tax revenue last year, while nearby Warren County received only $2.4 million.

"You have Warren County residents subsidizing Wake County schools," he said.

Similarly, he said, Mecklenburg County received $193 million in sales tax revenue last year, which was more than 50 of the state's poorest counties combined.

The structure creates a vicious cycle, Brown said, noting rural counties need to levy "sky-high property taxes" to pay for their schools and infrastructure, which discourages economic growth.

"This is the big reason we have two North Carolinas – one booming and one busting," he said. "Large urban counties have had an unfair advantage for decades."

Wake County would roughly break even under the new system because it's sales tax revenue is growing so rapidly, while Durham County would lose about 9 percent of its annual revenue. Other Triangle counties would benefit from the change, from 21 percent growth in Wilson County to 89 percent in Harnett County.

Dare County would be the biggest loser by far under the shift, with about 59 percent of its annual sales tax revenue going to other counties.

Brown said people shouldn't feel sorry for Dare County, noting that "adjustment factors" adopted in the 1980s mean the county has raked in 49 percent more that would be expected per capita in recent decades.

Both the North Carolina Metropolitan Mayors Coalition and the North Carolina League of Municipalities said changes to the sales tax system should benefit everyone, not some at the expense of others.

"The sales tax redistribution proposal doesn’t take into account how North Carolina as a whole can be competitive and successful. We hope to work with the legislature to develop an economic development strategy that raises all boats," Huntersville Mayor Jill Swain, chairwoman of the coalition, said in a statement.

“Municipalities need solutions that do not create winners and losers," League of Municipalities spokesman Scott Mooneyham said in a statement. "It is worth noting that several of the communities that would appear to be damaged by this plan are rural. You would have a hard time convincing the crabbers and commercial fishermen living in Newport, the shipyard workers living in Moyock and the shop owners living in Seven Devils that they have been the beneficiaries of an unfair tax system.”

The three-year changeover would give counties time to adjust their budgets, Brown said, adding that the adjustment factors would be eliminated over the same three-year period.

"There will be far more winners than losers," he said. "Urban counties will have to tighten their belts a little."