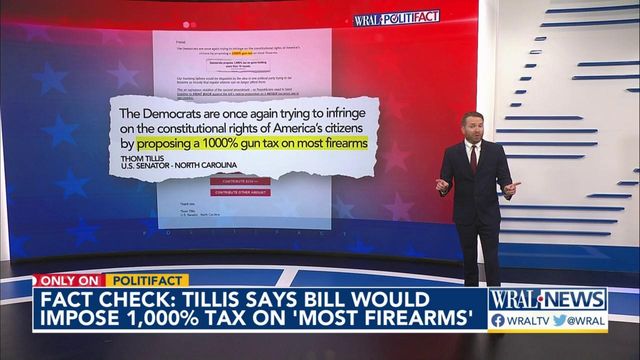

Fact check: Tillis says bill would impose 1,000% tax on 'most firearms'

One of North Carolina’s Republican U.S. senators is asking supporters to donate to his reelection campaign to help fight a Democratic effort to raise taxes on guns.

“The Democrats are once again trying to infringe on the constitutional rights of America’s citizens by proposing a 1000% gun tax on most firearms,” an Aug. 14 email from the Thom Tillis Committee said.

“But we can’t defeat the gun-grabbing Democrats without the continued support of America’s grassroots patriots, friend,” the email continued. “Please consider making a contribution to help Republicans defend our Second Amendment rights and fight back against the Democrats’ radical 1,000% gun tax proposal.”

The email didn’t provide evidence to support its claim. Tillis’ office and campaign committee didn’t respond to requests for comment.

The email appears to be referring to a bill sponsored by U.S. Rep. Don Beyer, D-Va., that would impose a new 1,000% excise tax on assault weapons and other firearms with high-capacity magazines, Fox News reported last month.

While the bill is now available at Congress.gov, it had not been published online when the Fox News article was published or when the Tillis email was sent.

So we sought to find out: Does the bill propose a 1,000% tax? Yes. Would it affect “most” firearms? That’s unclear.

Although some legal scholars said there is legal basis to assume the bill is constitutional, that’s ultimately a matter for the courts and not something we at PolitiFact are able to rate.

Here’s why the Tillis claim merits scrutiny.

The proposed tax

Tillis’ email doesn’t explain the type of tax Beyer’s bill proposed. It would impose a 1,000% excise tax on “semiautomatic assault weapons” and large capacity ammunition feeding devices.

This wouldn't be like a property tax that's due every year. It would apply only to the sale of new firearms — a detail the Tillis email leaves out.

Historically, the term "assault weapon" hasn’t had a consistent definition. For example, a bill called the Assault Weapons Ban of 2018 defined an assault weapon differently than the federal law that banned assault weapons from 1994 to 2004, before expiring.

Beyer’s bill defines assault weapons as those that can hold more than 10 rounds in a fixed magazine, that have the ability to use a non-fixed magazine, that have a pistol grip, a forward grip, a detachable or adjustable stock, a functional grenade launcher, a barrel shroud or a threaded barrel.

The bill defines a high-capacity ammunition feeding device as a “magazine, belt, drum, feed strip” or similar device that can hold more than 10 rounds of ammunition.

Number of guns affected

Experts said it’s difficult to determine whether the bill’s proposal would affect “most guns” for a couple reasons: the number of variables in the bill, and the fact that the U.S. doesn’t have a national gun registry.

“The best way to ballpark the percentage would be to ask what percentage of the firearm market consists of ‘semiautomatic assault weapons,’” Andrew Willinger, executive director of Duke University’s Center for Firearms Law.

Willinger noted that, in a recent court case challenging Connecticut’s assault weapons ban, the National Association for Gun Rights argued that 35% of all newly-manufactured guns sold in 2018 were “modern semiautomatic rifles.” In a case against Delaware’s assault weapon restrictions, other gun advocates cited statistics from the 2021 National Firearms Survey of 16,000 gun owners in the U.S.

The survey found that 48% of gun owners have owned magazines that hold over 10 rounds — a type of magazine that would be subject to the tax — and 30% of gun owners have owned an AR-15 or similarly styled rifle.

Beyer’s office pushed back at the claim that “most guns” would be affected by the bill, calling it a “big stretch.” Aaron Fritschner, Beyer’s communications director, cited a 2021 report published by the U.S. Bureau of Alcohol, Tobacco, Firearms and Explosives, known as ATF. It found more pistols were manufactured in 2019 than any other type of firearm. More than 7 million firearms were manufactured that year, 3 million of which were pistols and 1.9 million of which were rifles.

Philip J. Cook, a professor of public policy studies at Duke University and an expert on gun control, said the ATF’s 2021 report is a reliable source for information about firearms introduced in the marketplace. But he said the National Shooting Sports Foundation, a trade association for the firearms industry, would have insight into sales trends.

Mark Oliva, a spokesman for the foundation, acknowledged that the number of variables in the bill make it “difficult” to determine what percentage of gun sales would be affected. It would come down to the specifics of each firearm sold, he said.

“A claim that this would affect ‘most’ firearms available for sale today doesn’t appear to be hyperbole, when taking into account that many bolt -action rifles and shotguns have design features that include telescoping or collapsible stocks, threaded barrels, pistol grips,” and other features that would qualify for the tax, Oliva said in an email.

David Kopel, research director of the Independence Institute, believes the email’s claim has credibility.

“First, the bill taxes the most popular rifles sold today, which are in themselves a substantial fraction (but not the majority) of total firearms sales,” Kopel said in an email. “Second, the bill taxes the vast majority of standard magazines that are sold with semi-automatic pistols.”

Pistols could certainly be modified with features that qualify for the proposed tax, said Fritschner, Beyer’s spokesperson. While it’s “not the intent of the bill to target most models of handguns,” he acknowledged that it would be “impossible to say with precision” what the percentage would be affected.

Whether it’s ‘unconstitutional’ is a question for the courts

Tillis’ email says the bill would be an “egregious violation of the Second Amendment” — a claim Fritschner said is “flatly belied” by the fact that the U.S. banned assault weapons from 1994 to 2004, when the ban expired.

He also cited the National Firearms Act of 1934, which imposed large excise taxes on certain classes of firearms “that have remained in effect for nearly 90 years.” He said federal regulation of firearms is also supported by the U.S. Supreme Court’s 2008 ruling in District of Columbia v. Heller, written by the late conservative Justice Antonin Scalia.

Clark Neily, senior vice president for legal studies at the Cato Institute, said the court’s more recent decision in New York State Rifle & Pistol Association Inc. v. Bruen opens a new legal avenue for challenging proposals like Beyer’s.

“We don't have a definitive ruling on whether these features or these particular types of equipment are or are not constitutionally protected,” Neily said.

“It is true that most courts that have looked at it so far have said no. Some have said ‘yes,’ but most have said ‘no.’ But most of those decisions — in fact, almost all of those decisions — preceded the Bruen case,” he said. “I would say that the bill raises serious constitutional concerns. I probably wouldn't go further than that.”

Willinger, from Duke’s Center for Firearms Law, agreed that the Bruen decision is relevant but hesitated to forecast what it could mean for a bill like Beyer’s.

Our ruling

Tillis’s email says a new bill proposes a “1,000% gun tax on most firearms.” This description tells only half the story.

A Democrat did introduce a bill proposing a 1,000% excise tax on guns, but it only applies at the point of sale — a detail that email leaves out.

Whether the bill would affect “most” gun sales is difficult to determine. There’s no national gun registry. And the scope of the bill — the fact that it applies not only to guns, but also numerous features that can be added-on — leaves experts with too many variables to pinpoint the bill’s marketplace effect.

These claims include some partially accurate information but leave out important details that would give readers a different impression of the facts. We rate them Half True.