State workers say treasurer gambling with their pensions

Lawmakers this year handed State Treasurer Janet Cowell authority to tweak the strategy of the state pension to boost earnings, but state workers say the increased risk isn't worth it.

Posted — Updated"It's my neck on the line and I go to bed every night thinking about that responsibility," Cowell said.

More alternative investments mean less pension money in lower-performing bonds. Changing interest rates have led to losses in the state's bond portfolio in recent months, she said.

"The North Carolina pension fund has always been a big investor in bonds, and that has served us really well, but we're at the end of that runway," she said.

Ardis Watkins, director of legislative affairs for the State Employees Association of North Carolina, said alternative investments usually mean large fees charged by outside portfolio managers.

"It's an awful idea, and we don't need to be putting an incredibly risky amount of money in alternative investments," Watkins said.

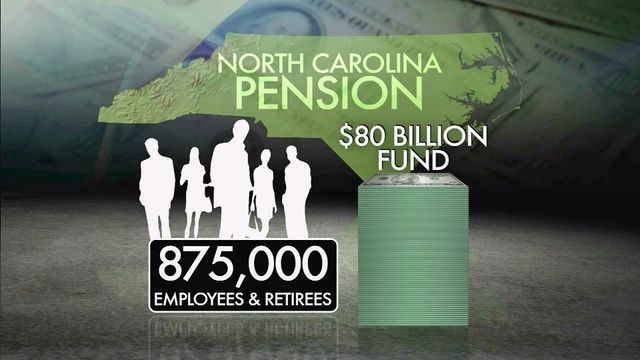

From 2000 to 2012, the state pension fund grew 32 percent, from $59 billion to $78 billion. Last year alone, assets grew by more than 9 percent.

Records obtained by WRAL News show that, during that same period, outside management fees ballooned more than 750 percent, from $41 million to $352 million.

Cowell acknowledged that shifting funds around would likely result in some higher fees "in the short term."

Pension funds across the country are shifting funds out of bonds into more expensive alternative investments, and Watkins said investment bankers are pushing the changes.

"Wall Street, in this case, controlled Jones Street," she said. "This is without question a very dangerous road."

Richard Warr, a finance professor at North Carolina State University's Poole College of Management, said North Carolina should steer away from expensive alternatives and plow fee savings into index funds that mirror the overall stock market.

"Everybody's playing the same game. There cannot be a magic bullet. We cannot all beat the market," Warr said. "(We should) basically try to lock in the broad market returns and build a low-cost, very diversified portfolio."

Cowell contends that she's got to worry about the long and short term.

"That is sort of the choice: Dial up slightly the risk-return, otherwise, the other choice is you just put in more taxpayer money (to meet obligations)," she said.

SEANC has fought for years to decrease the control the State Treasurer's Office has over the pension fund. Cowell is forming a study committee to consider other management models.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.