Raleigh, Wake change course, raise taxes

Raleigh residents are about to take two hits to the wallet.

Posted — UpdatedAlthough 2015-16 budgets for much of the Triangle don't raise property taxes, both Raleigh and Wake County officials passed tax increases that take effect in July.

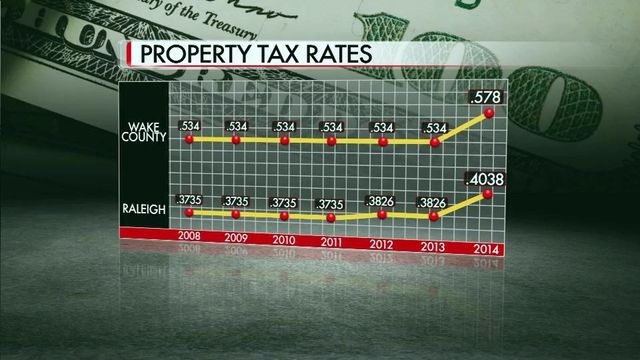

The Wake County Board of Commissioners voted to raise the property tax rate by 3.65 cents, while the Raleigh City Council approved a budget that includes a 1.72-cent increase to the tax rate.

Combined, the two increases will mean an extra $80.55 in property taxes next year for the owner of a $150,000 home.

That is in stark contrast to recent years, when local residents enjoyed a steady tax rate. Asside from increases tied to voter-approved bond referendums, Wake County hasn't adjusted its tax rate since 2008, and Raleigh's only change in that time was 1-cent increase to its rate last year.

Mike Walden, an economist at North Carolina State University, said Wednesday that changing economic conditions are likely behind the recent tax increases.

"During recessions, the point is to keep the lights on. So, public officials rightly think, 'Wait a minute. Let's not go off and do any big projects. We just want to keep the books balanced,'" Walden said. "Then, when things improve, as they have, they look around and see, 'Well, we want to build some new parks, and maybe we want to fund the schools more.'"

Much of the Wake County increase would go toward funding local schools, while Raleigh's increase is targeted at various services, from fire stations to expanded parks to infrastructure.

Raleigh homeowner Ron Aycock said that he doesn't mind the recent property tax increases, pointing to the heavy load that local governments carry.

"I need to pay for what I get," Aycock said. "We have police protection, fire protection. We have infrastructure, streets, water and sewer that need to be maintained."

Still, Ed Jones, chairman of the Wake County Taxpayers Association, said that local leaders need to be more fiscally conservative.

"I know we have some needs," Jones said. "We just can't keep spending, spending, spending and taxing, taxing, taxing people. There comes a limit, and I think small-business people now who are struggling to recover from the recession and people of more modest means will suffer."

All property in Wake County will be revaluated in 2016, so the tax rates will likely drop as property values are adjusted upward.

Even with lower tax rates, however, tax bills may not go down.

"As you squeeze more people into a given area, land values are going to go up. It will be more expensive to build schools, build roads. So, long term, we may be looking at higher tax rates to keep up with this tremendous growth," Walden said. "That’s the cost of living in a metropolitan area, particualry a growing one."

In addition to that, Wake County commissioners are already talking about putting a multimillion-dollar school bond and a half-cent transit tax on the 2016 ballot, and Raleigh residents could see a bond initiative in the near future to help pay for transforming the Dorothea Dix campus into a major park.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.