Patients can challenge when ER bills aren't covered by insurance

What happens when your insurance company doesn't think your trip to the ER was really an emergency? There are ways to fight back when your insurer won't foot the bill.

Posted — UpdatedWhat happens when your insurance company doesn’t think your trip to the ER was really an emergency? There are ways to fight back when your insurer won’t foot the bill.

Severe pain in the middle of the night landed Kimberly Fister-Mesch in the ER. She thought she was having a stroke.

"The pain was so intense that I knew something had to be wrong," she said.

To her relief, it wasn’t a stroke but a serious inner ear infection.

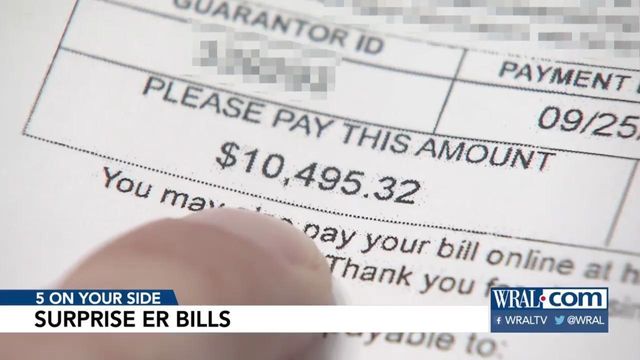

"And then I saw the bill, and that’s when my blood pressure went up again," she said.

Fister-Mesch was charged $4,300 because her diagnosis wasn’t considered a medical emergency by her insurer, Anthem. Anthem said she should have called the company’s 24/7 online doctor service or gone to her own doctor or urgent care.

Anthem isn’t the only health insurance company trying to discourage costly emergency room care. Many insurers charge a higher copay for ER visits, compared with urgent care or walk-in clinics.

But Consumer Reports believes Anthem’s approach takes those efforts to a potentially dangerous new level. Consumer Reports and medical experts say policies like Anthem’s are leaving consumers with huge medical bills and could keep patients from going to the ER when they should.

"People don’t come to us because they want to come to us. They come to us because they need us," said Dr. Ryan Stanton.

Before a health crisis hits, subscribers should make sure they understand what their insurance policy will cover.

"Check your insurer’s 'emergency service benefits' coverage to see how it defines an emergency and what your plan will and won’t cover," said Margot Gilman, Consumer Reports money editor.

While most insurers offer general guidelines as to what constitutes an emergency, they don’t limit policy holders to specific injuries or illnesses. Anthem makes many exceptions to its ER policy, including for patients under 15 or for those who are told to go to the ER by their doctor.

And if your insurer rejects a claim, you have the right to do what Fister-Mesch did: file an appeal. She sent a letter to her insurer, along with her medical records, and filed a complaint with her state’s insurance regulator. Anthem ultimately reversed its decision.

Anthem told Consumer Reports it's simply trying to rein in the overuse of ERs for minor problems. The insurer says the ER is a time-consuming and costly place to get care that could be handled elsewhere.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.