Military leaders speak out against loan bill

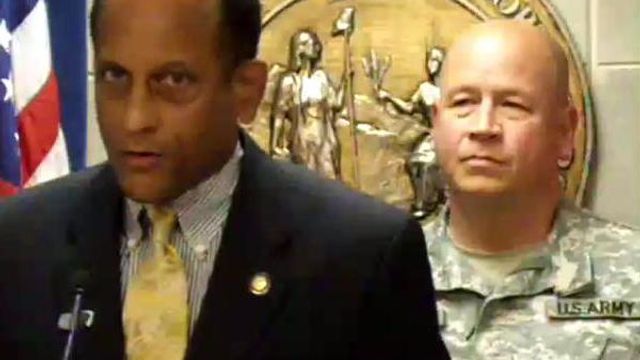

Military leaders joined lawmakers and consumer advocates today to speak out against a proposal to allow lenders to raise the cost of small loans.

Posted — UpdatedMilitary leaders joined lawmakers and consumer advocates today to speak out against a proposal to allow lenders to raise the cost of small loans.

The bill, H810, would allow consumer lenders to charge higher interest on larger loans. Under current law, lenders can charge 36% interest on the first $600 loaned. H810 would raise that ceiling to $1500. It would also make it easier for borrowers to "roll over" old loans into new debt, the same model used by the payday lenders state lawmakers banned several years ago.

Lenders say it's been more than two decades since they've been allowed to raise their rates, and they're having trouble keeping up with the rising costs of doing business. But a study by the NC Commissioner of Banks said the industry is making enough profit at its current rates.

The military has taken a special interest in the bill because servicemembers are a favored demographic for lenders making small, unsecured loans at high rates. The industry's critics complain those lenders cluster near the gates of bases, often using flags and military-sounding names to make them seem legitimate or even sanctioned.

Mike Archer directs legal services for Marine Corps families on the East Coast. He appeared today on behalf of the Department of Defense and Defense Secretary William Gates. "Let me make something perfectly clear: the Secretary is opposed to House Bill 810 in its original form. And the Secretary is opposed to the amended House bill."

Archer said the Department of Defense generally doesn't seek to intervene in state legislative matters, but did in this case because the measure would adversely and disproportionately affect servicemembers.

"These industries tend to target servicemembers," Archer explained. "They find 57,000 servicemembers all in one place, many of them very young, very unsophisticated, to be an irresistible target."

Watch the full press conference at right.

Archer says inexperience, stress, separation from family and friends, and marital problems caused by deployment are among the reasons servicemembers tend to get into trouble with easy, high-cost loans. The resulting financial problems become yet another source of stress for the soldier-borrower. Archer also said credit problems can cause a servicemember to lose security clearance, and training a replacement costs the military money.

The House put off its scheduled vote today on H810. It's expected to be debated on the floor Thursday.

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.