Lawmaker wants to close Lowe's sales-tax loophole

A powerful lawmaker said that the General Assembly needs to clarify the state tax code so that Lowe's Cos. will have to collect sales tax on goods the retailer's crews install in customers' homes.

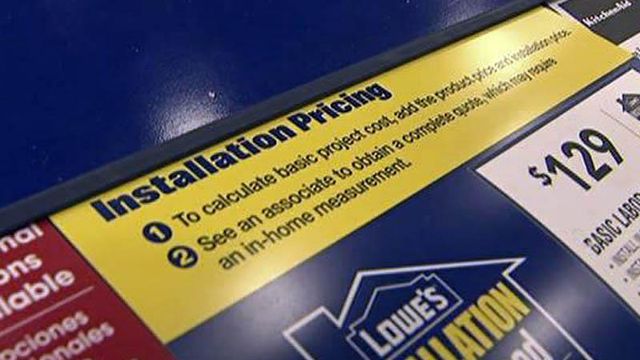

Posted — UpdatedMooresville-based Lowe's doesn't charge sales tax on items like windows, carpeting, tile, cabinets, counter tops and appliances that store contractors install. Customers pay the tax only when they buy the goods at a Lowe's store for a do-it-yourself project.

Lowe's officials said they were following the state law on contractor performance agreements.

The law states that contractors like plumbers and furnace repairmen pay what's commonly called a "use tax" for products used in repair projects and then roll that cost into the final bill, which doesn't include an itemized sales tax charge. Because most contractors get wholesale discounts, the use tax they pay wouldn't reflect any retail mark-ups that would be included in the price on which a do-it-yourselfer’s sales tax would be calculated.

Senate Majority Leader Tony Rand said Friday that contractor performance agreements were never meant to apply to retailers like Lowe's.

"That's certainly not the intent of the law," said Rand, a Cumberland County Democrat.

Use taxes likely bring in millions of dollars less to North Carolina's coffers than retail sales taxes would – revenue that is sorely needed as the state faces a $2 billion budget deficit.

"The state's losing revenue, in my opinion, and we certainly can't afford for that to happen. We need to get that straight," Rand said.

Lowe's competitors, from Home Depot Inc. to local home-improvement stores, charge sales tax on materials regardless of whether their crews install the goods for customers.

"We want (customers) to know what it is, and actually, I feel like we're accountable for how we do business," said Glen Anderson, general manager of Carpet One in Fayetteville.

Anderson and other home improvement dealers said Lowe's promise of no sales tax on installed items gives the chain a competitive advantage. Anderson said he wonders whether Lowe's customers understand they're still footing the bill for some tax, even though it's not shown on the receipt.

"I'd just say it's misleading," he said of the "no sales tax" promise. "I feel like we need to be playing by the same rules and being held accountable the same way."

The state Department of Revenue won't discuss the issue, citing taxpayer confidentiality. An official said in a statement that the agency is working to ensure "all North Carolina businesses meet their tax responsibilities and pay their fair share."

Sources told WRAL News the department has been in a long-running dispute with Lowe's over the company's reading of the law. The disagreement could lead to litigation.

Rand said lawmakers need to clarify the tax code to prevent further misinterpretations.

"They're trying to find the niche and trying to find a little better mouse trap, but we didn't mean for that mouse trap to be open. So, we'll see if we can't make sure it's closed," he said.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.