Legislation could mean online sales tax

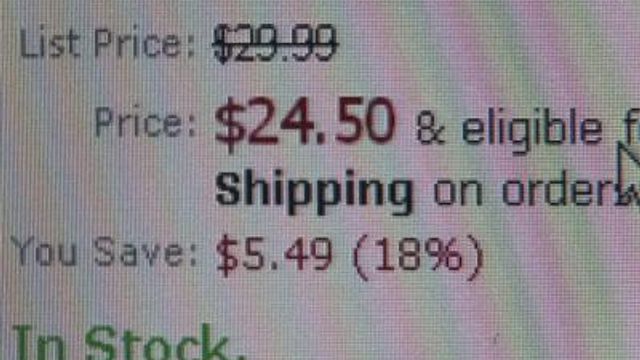

One of the biggest perks of online shopping – the chance to not pay sales tax – could go away under a bill in Congress.

Posted — UpdatedA bill in Congress called the Main Street Fairness Act could change that.

The bill, introduced in the U.S. House of Representatives last month by Massachusetts Democrat Rep. Bill Delahunt, would help states retrieve lost revenue that goes uncollected because of complex, outdated sales tax rules across the country.

To date, 24 states have entered into the interstate compact, which contains a uniform set of guidelines. The bill does not compel any state to join, but those that choose to adopt the system would then have the authority to require online retailers to collect and remit sales taxes the same way that local businesses do.

Supporters of the bill say it is an issue of fairness and competition and it will help ensure that online retailers are playing by the same rules as local retailers.

Gov. Bev Perdue supports the effort to tax all online purchases. She believes a successful solution has to come from the federal level.

"It's kind of like immigration reform," she said. "You can't have 50 different systems, which is where the states are headed now. You've got to have a national system."

Currently, locally owned stores like Quail Ridge Books in Raleigh have to charge a sales tax. Online competitors, like Amazon.com, only have to charge sales tax if a purchase is made in a state where they have a physical presence.

In other states, residents are supposed to self-report online purchases when filing their tax returns. But many consumers do not.

In North Carolina, for example, for the 2008 tax year, 109,003 tax returns were filed that reported online purchases. The total amount was $5 million.

"I did not ever think there'd be an unlevel playing field like this," said Quail Ridge owner Nancy Olson said.

She believes the online retailers work off an unfair business model. One she says is causing many local businesses to go under.

"Amazon is even hurting the chain stores," Olson said. "Some of them are ready to go down."

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.