Mortgage mess not at crisis level in Wake

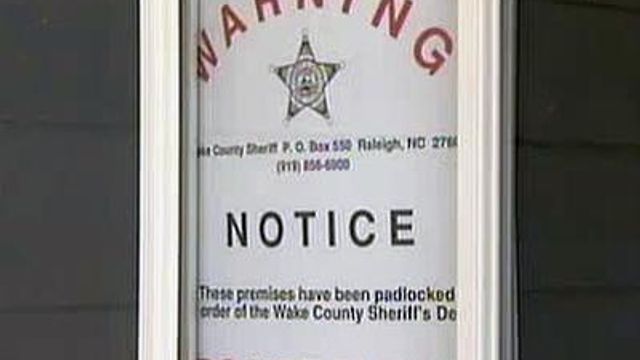

Foreclosure filings in Wake County are up about 60 percent from last year, but the rate of properties actually taken by lenders is on pace for a 14 percent increase, according to a Raleigh-based foreclosure tracking Web site for investors.

Posted — UpdatedOne of every 416 homes nationwide is in some stage of foreclosure, according to RealtyTrac, a California-based foreclosure tracking firm. RealtyTrac data also shows foreclosure proceedings in North Carolina more than doubled in July over the same month last year.

"Any foreclosures are a problem, whether it's in North Carolina or nationally, but I think there's a discrepancy in the numbers of filings that have occurred and then the actual number of foreclosures that actually go into final foreclosure," said Jeremy Salemson, chief executive of Corporate Investors Mortgage Group in Raleigh.

Foreclosure filings in Wake County are up about 60 percent from last year, but the rate of properties actually taken over in the county is on pace for a 14 percent increase, according to epreforeclosures.com, a Raleigh-based foreclosure-tracking Web site for investors.

Last year, 1,400 deed-of-trust foreclosures occurred in Wake County, epreforeclosures.com reports. So far this year, 1,133 have taken place.

Mortgage industry officials credit the relatively strong economy in the Triangle and a housing market where many can still get good prices for homes. But they also noted there are now more places where homeowners can turn for help to save their homes.

"I think the old mindset was, 'I've missed a payment or two on my mortgage. I'm doomed to foreclosure. I have nowhere else to turn.' That's absolutely not the case at this point," Salemson said.

"There are options out there for you," Salemson said. "Pick up the phone, call these numbers, whether on the federal level or the state level, and I think you'll find there are some solutions for you that maybe you didn't know about before."

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.