In Wake of Fires, More Renters Are Buying Insurance

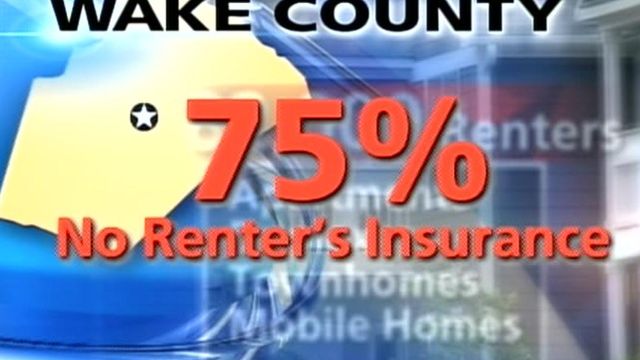

Insurance companies say more people are applying for renter’s insurance after several major apartment fires in Raleigh recently.

Posted — UpdatedWithout insurance, Burgher and Duncan will have to find some way to replace everything destroyed by the fire.

Last week, a fire at the Concord Apartments displaced 29 people. None of them had renter’s insurance.

“You never think it's gonna be you who's affected by the incident, but it can happen to anyone," Concord renter Sarah Doman said. She and her roommate, Becky Bascom, were uninsured.

He warned that some renters don't recognize the risks. "The thing about an apartment community is you are responsible for every single person beside you. If they leave a candle on or an iron on, that can cause a fire."

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.