Orange's Transfer Tax Campaign Irks Some

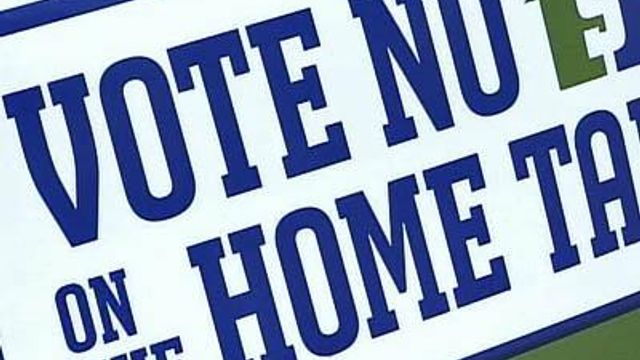

Realtors and others are balking at Orange County's decision to spend $100,000 to educate voters about land transfer taxes before the May 6 primary, when county residents will be asked to approve the tax.

Posted — UpdatedThe transfer tax was one of two options that state lawmakers approved last year to give counties some choices in generating revenue to deal with growth-related needs, such as new schools, wider roads or more water and sewer lines. The tax would charge home-sellers 0.4 percent of the sales price.

Orange County commissioners said homeowners must pick from a transfer tax or higher property taxes to fund new schools and parks.

"Either you pay us now, or you pay us later," said Barry Jacobs, chairman of the Orange County Board of Commissioners.

The media campaign would be heavily scrutinized to ensure it doesn't cross the boundary from providing information to advocating approval of the tax, Jacobs said.

"I'm going to move to the edge very carefully. I don't want to fall over the edge," he said. "I think it's important that we be dispassionate reporters of fact to our voters."

Jacobs said the campaign is needed to combat a well-funded real estate lobby intent on killing the tax.

Last fall, transfer tax proposals failed in all 16 counties that voted on them. Ashe, Gates and Polk counties also have the tax on their ballots in May.

When Wake County put school and open space bonds on the ballot, the campaigns for and against them were led by private citizens and private dollars. Aside from some brochures, commissioners kept taxpayer money out of the fight.

"If there's any element that might be advocacy, we step away from it," said Joe Bryan, chairman of the Wake County Board of Commissioners.

Mark Zimmerman, a real estate agent in Chapel Hill, said he wishes Orange County officials would do likewise.

"A lot of people are very, very upset that $100,000 of our tax dollars are going to be used in a campaign to try to get people to accept another tax," Zimmerman said. "I don't understand why it has to take $100,000 to do that."

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.