McCrory offering new plan for historic tax credit

Gov. Pat McCrory plans to push a revised tax credit for rehabilitating historic properties across North Carolina in order to resurrect the economic development tool, Secretary of Cultural Resources Susan Kluttz said Monday.

Posted — UpdatedThe credit was eliminated in a tax reform package the General Assembly passed in 2013, and it formally expired on Jan. 1.

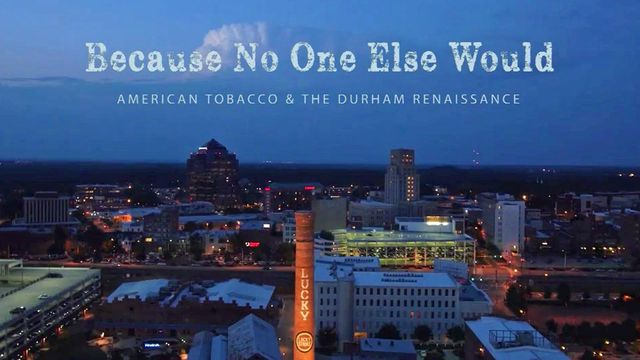

Kluttz led state and local officials on a Monday morning tour of the American Tobacco campus in Durham to highlight the success of the tax credit. Capitol Broadcasting Co., the parent of WRAL, used the credit to transform the abandoned cigarette manufacturing complex into an integral part of Durham's downtown.

"You're talking about a lot of money involved in a large project and a very risky project based on where Durham was at that time," said Michael Goodmon, Capitol's vice president for real estate. "For a company like ours, the tax credit was critical. This project does not happen without historic tax credits."

Kluttz, a former Salisbury mayor, said she's heard that refrain often from developers.

"The numbers don't work" without the credit, she said. "These (credits) provide a level playing field for new construction versus coming in and helping a community by taking a deserted, empty building and using it."

The historic preservation tax credit has been used in 90 of North Carolina's 100 counties and has generated $1.6 billion of private investment since 1998, officials said.

Still, some lawmakers said the credit gave an unfair benefit to developers at the expense of other taxpayers. They have suggested that the state appropriate funds to help improve old buildings.

McCrory plans to revise the credit to make it more palatable to lawmakers, Kluttz said. She said the plan would offer smaller credits to larger projects, and the total cost of the program would be capped.

"There will still be enough incentive that developers can use it," she said. "It’s a compromise plan that we feel the legislators could and should accept."

"You have to invest in what matters to you," Goodmon said. "So, if the fabric of our communities are important and we want buildings repurposed and reused and downtowns brought back to life, then investing in those from a state perspective or even a local perspective is critical.

"The community realizes the importance of it," he continued. "In almost every community now, you have great repurposed historic structures."

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.