Local credit union uses interactive teller machines

Raleigh-based Coastal Federal Credit Union is changing automated banking with personal teller machines - financial kiosks with a teller on the other end.

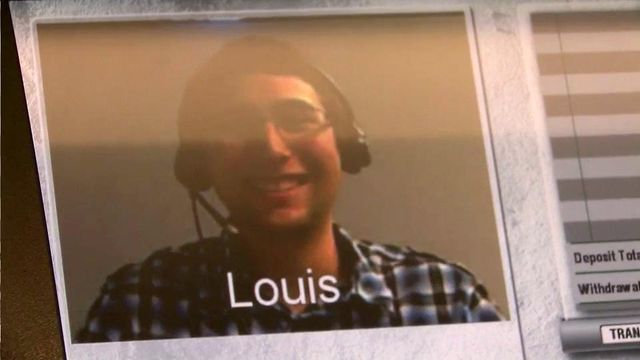

Posted — UpdatedLike ATMs, the machines have cash dispensers and check scanners, but they also have a camera and a teller on the other end who can see and interact with customers.

Raleigh-based Coastal Federal Credit Union is the first financial institution in the world to use the kiosks at its 15 area branches, and Chief Executive Officer Chuck Purvis says the technology is cutting costs, time and crime.

"We're saving about 40 percent of our cost providing tellers than where were five years ago," he said Tuesday. "We're saving 40 percent on labor while we extend our hours 86 percent. That's a pretty good formula."

Purvis says that by centralizing tellers at the credit union's corporate office off Wake Forest Road, branches have been able to extend their hours from 7 a.m. to 7 p.m. every day.

The goal, he says, is to have around-the-clock operations with bilingual tellers.

Coastal Federal Credit Union branches still have employees present to take care of financial needs such as loans and mortgages, but there are no tellers on site.

That, Purvis says, has proven, so far, to be a deterrent to robberies. Since the credit union completed its rollout several years ago, there have been no robberies.

"It's safer for members who are in the branch, because it's a machine to a would-be robber that walks in," Purvis said. "They don't see a teller line."

The prospect of safer banks and interactive banking machines is also attracting attention from financial institutions across the world, including Asia, the Middle East and Europe.

"We know that the major banks are working on projects to begin rolling out this technology," Purvis said. "It feels awesome. We know that we've got a four- to five-year advantage on all the other financial institutions."

The credit union, he says, has actually formed a company to commercialize the technology and hosts demonstrations each month that, on average, attract about 25 people from 8 to 10 financial institutions, including well-known ones like Bank of America.

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.