Lawmakers back tax on e-cigarettes

North Carolina lawmakers are backing a proposal to add an excise tax to the liquid used in vapor, or electronic, cigarettes.

Posted — UpdatedE-cigarettes are a fast-growing segment of the U.S. tobacco products market. The state currently imposes a sales tax on the devices but does not collect an excise tax as it does on cigarettes and other tobacco products.

Instead of burning tobacco, the electronic devices use a battery to heat a liquid containing nicotine, turning it into vapor. The product itself doesn't contain tobacco, but the nicotine is derived from tobacco, so the U.S. Food & Drug Administration has classified the devices as tobacco products.

The draft legislation approved Tuesday by the Joint Revenue Laws Study Committee would tax the nicotine-collecting liquid at a rate of 5 cents per milliliter.

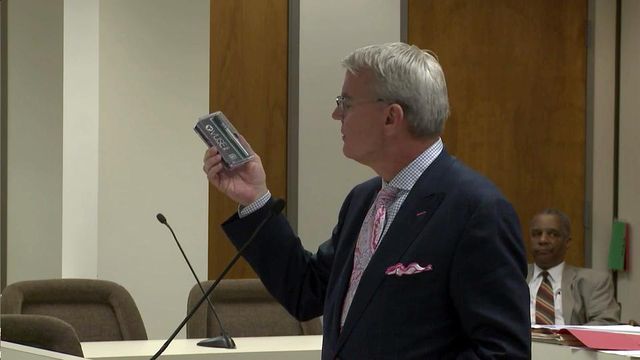

For comparison, Vuse, the new R.J. Reynolds electronic cigarette currently being test-marketed in Colorado and Utah, contains less than a milliliter of liquid, but it is equivalent to about a pack of traditional cigarettes.

If implemented during the upcoming short session, the tax is projected to bring in about $2.1 million in the 2014-15 fiscal year and $5 million in the 2015-16 fiscal year.

The proposal had strong support from R.J. Reynolds, which asked lawmakers not to tax the devices as either traditional cigarettes or other tobacco products.

"They're not the same," David Powers, vice president of government relations for Reynolds, told the committee.

The alternative, currently under consideration in several states, would be to tax e-cigarettes as traditional cigarettes, which would be far pricier. North Carolina's current tax on cigarettes is 45 cents per pack. Other tobacco products, from cigars to snuff, are taxed at 12.8 percent of cost.

Powers said many smokers are switching from cigarettes to e-cigarettes, adding that the vapor devices carry less health risk because no tobacco smoke is produced.

"We don’t want to create disincentives for smokers to try it," he said.

Sen. Floyd McKissick, D-Durham, called the proposed 5 cent tax a "good place to start," but he added that lawmakers may need to consider raising it in coming years as the state budget begins to lose revenue from people making the switch from traditional to electronic cigarettes.

The draft legislation now goes to the full legislature for consideration.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.