Hurricanes, Panthers growl over proposed sales tax change

Representatives of the Carolina Hurricanes and the Carolina Panthers asked lawmakers Tuesday to back off a plan to require that sales taxes on game tickets be paid at the time of purchase, saying it would create an accounting nightmare for the teams.

Posted — UpdatedA sweeping tax reform package passed last year expanded sales taxes to a number of items, including tickets to movies, sporting events and other entertainment. As the General Assembly prepares to reconvene Wednesday, the Joint Revenue Laws Study Committee reviewed a 48-page draft bill Tuesday that would tweak some of the changes made last year.

Billy Traurig, general counsel for the Hurricanes, said the team records revenue only after each game, not as tickets are sold. Collecting sales taxes on tickets and immediately turning them over to the state would require extra people at each ticketing location, could increase the chances for errors in calculations and would make auditing the process much more complex, he said.

"Tickets, to us, are different than tangible personal property because, when you purchase a piece of personal property, you receive it and get to enjoy it as soon as you receive it," Traurig said. "The entertainment is what we're selling, and the entertainment is not delivered until the time of the event. At that point, that is where we believe the taxable transaction takes place."

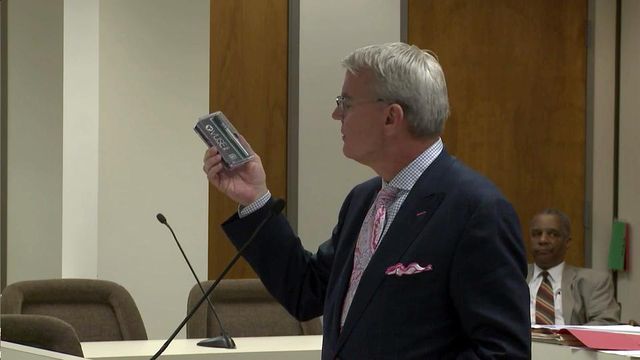

Traurig and Richard Thigpen, general counsel for the Panthers, said they would prefer to turn in sales taxes on a regular, but less frequent, schedule, where they could be broken down more easily by event. All entertainment venues would have the same concern, Traurig said.

"As the sales tax is expanded and put into place for different businesses, just consider how these different businesses operate – what their models are like – and work with them to make it efficient," Thigpen said. "The goal is certainty of tax ... and in our business, it's really not known until the event has occurred."

Rep. Becky Carney, D-Mecklenburg, said she supports the request for better efficiency, but lawmakers took no action on it.

Other changes in the omnibus tax bill include the following:

- Eliminate the privilege license system many cities use to tax businesses and replacing it with a flat tax capped at $100. Sen. Floyd McKissick, D-Durham, said lawmakers would need to work with cities to find ways for them to replace the lost revenue.

- Exempt 50 percent of the cost of mobile or modular homes from sales tax. Last year, lawmakers removed a $300 sales tax cap on mobile homes and increased the tax rate from 2.5 to 4.765 percent.

- Clarify when taxes are due on service contracts purchased with appliances and how refunds are issued if the contract ends early.

- Levy taxes on vacation homes that are rented for fewer than 15 days a year if the homes are listed with a rental agent.

Lawmakers also rolled a change to the state corporate income tax into the omnibus bill, despite the reservations of some committee members.

By altering the formula used to calculate how much tax is owed by multi-state businesses, North Carolina would collect more tax from firms that sell a lot of merchandise in the state but have no manufacturing facilities here. Meanwhile, firms with a manufacturing base in state would likely see their taxes go down.

"In the last session, as you all know, we did a massive restructuring of the tax code," said Rep. Mitch Setzer, R-Catawba. "This sounds like a wonderful concept, but when you look at the bottom line of where we are at this point in history, we really should wait and put this on the back burner and see what our revenues are going to be. This is going to cost revenue in the current budget situation.

Sen. Bob Rucho, R-Mecklenburg, said the proposed change needs to go forward to help North Carolina attract more manufacturing jobs, noting that Commerce Secretary Sharon Decker favors the adjusted formula.

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.