Tentative 'cliff' deal reached too late for deadline

Racing against the clock, the White House reached agreement with congressional Republicans late Monday on a deal to prevent across-the-board tax increases and spending cuts to government programs from taking effect at midnight, according to administration and Senate Democratic officials.

Posted — UpdatedThese officials said a New Year's Eve vote in the Senate to ratify the deal was possible, barring opposition from majority Democrats. The House has recessed until noon Tuesday, so full approval of the deal won't meet the midnight deadline.

Vice President Joseph Biden, who negotiated the deal with Senate Republican leader Mitch McConnell, was briefing the Democratic rank and file on Capitol Hill late Monday.

House Speaker John Boehner and his leadership team said they need to review the deal before deciding to schedule a vote on the measure or try to change it. Democrats would likely oppose any effort to amend the measure to make it more to GOP liking, which would likely make it almost impossible for Republicans to quickly rewrite the measure.

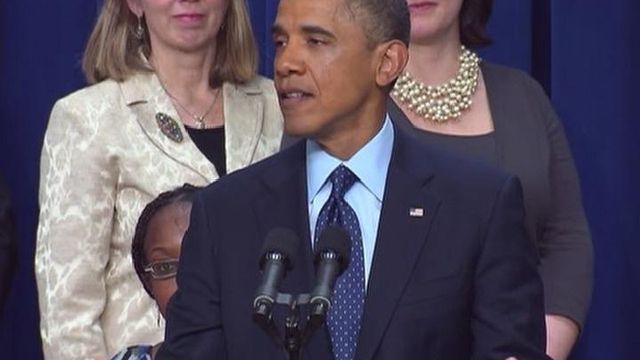

President Barack Obama and McConnell said earlier Monday that they were near a deal to avoid the fiscal cliff.

The deal calls for preventing tax increases on most Americans, while letting rates rise on individual income over $400,000 and household earnings over $450,000 to a maximum of 39.6 percent, from the current 35 percent. That marked a victory for Obama, who campaigned successfully for re-election on a platform of requiring the wealthy to pay more.

Any agreement would also raise taxes on the value of estates exceeding $5 million from 35 to 40 percent, as well as extend expiring jobless benefits for 2 million unemployed, prevent a 27 percent cut in fees for doctors who treat Medicare patients and likely avoid a near-doubling of milk prices.

Much or all of the revenue to be raised through higher taxes on the wealthy would help hold down the amount paid to the Internal Revenue Service by the middle class.

In addition to preventing higher rates for most, any agreement would retain existing breaks for families with children, for low-earning taxpayers and for those with a child in college.

The two sides also agreed to prevent the Alternative Minimum Tax from expanding to affect an estimated 28 million households for the first time in 2013, with an average increase of more than $3,000. The law was originally designed to make sure millionaires did not escape taxes, but inflation has gradually exposed more and more households with lower earnings to its impact.

Members of North Carolina's congressional delegation expressed frustration that weeks of haggling couldn't produce a deal in time to avoid the cliff, which many economists say could throw the U.S. back into recession.

"What really worries me is there does not seem to be a deal in place at all with respect to spending or the debt ceiling, and the debt ceiling is how we got into this foolishness in the first place," Democratic 13th District Congressman Brad Miller said. "If we don't deal with the debt ceiling in this deal and we are back in two months to where we were in September of 2011, that's going to be worse for the economy than going over the cliff."

"(These are) terribly delicate issues – taxation on one hand and spending on the other," Republican 6th District Congressman Howard Coble said. "Spending has brought us to the brink of this cliff, and I don't think we can afford to ignore either of those two."

McConnell suggested Congress move quickly to pass tax legislation and "continue to work on finding smarter ways to cut spending" next year.

"We're going to have plenty of time in January and February to talk about spending cuts (and) about reform of entitlements," Republican U.S. Sen. Richard Burr said. "The American people demand that part of it, and the rubber's going to meet the road then."

The White House and Democrats initially declined McConnell's offer, preferring to prevent the $109 billion in cuts from kicking in at the Pentagon and domestic agencies alike. Officials said they might yet reconsider, although there was also talk of a short-term delay in the reductions.

While the deadline to prevent tax increases and spending cuts was technically midnight, passage of legislation by the time a new Congress takes office at noon on Jan. 3 would eliminate or minimize any inconvenience for taxpayers.

• Credits

Copyright 2024 by WRAL.com and the Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.