House vote preserves new version of historic tax credit

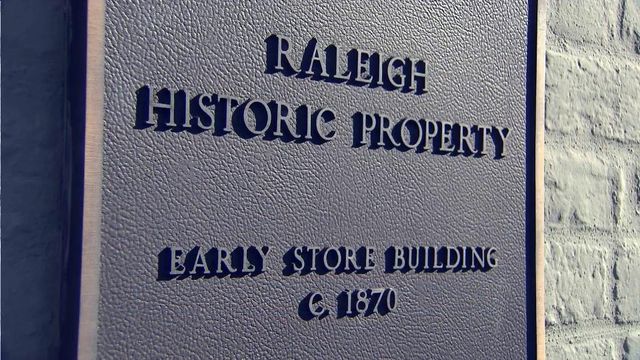

The House gave preliminary approval Wednesday to a measure that would establish a new tax credit for redeveloping old houses, factories and warehouses into new office and residential space.

Posted — UpdatedAfter the 96-18 vote, House members will hold a final vote on Thursday, when a couple of proposed amendments are expected to be debated, before the bill moves to the Senate.

The old historic preservation tax credit expired on Jan. 1 as part of an overhaul of the state tax code, and Gov. Pat McCrory's administration and local officials from across North Carolina have been trying to revive it, calling it a vital economic development tool for both urban centers and rural communities.

"This boosts local economies, creates jobs and, at the same time, it preserves communities and preserves the historic structures that made North Carolina great," said sponsor Rep. Stephen Ross, R-Alamance.

Ross noted that more than 2,000 projects using the old credit have been completed in 90 of North Carolina's 100 counties, generating $1.67 billion in private investment. The projects also created thousands of construction jobs and provided homes and offices that attracted new residents and businesses to various communities, he said.

"You can't put a calculation on the other things this does for a community," he said.

The new tax credit would be capped at $4.5 million for income-producing structures, such as old factory buildings that are converted into offices or condominiums. The credit for non-income-producing properties, such as historic single-family homes, would be capped at $22,500. The previous credit had no cap.

Developers could obtain higher credits up to the cap if a project is in an economically distressed county.

Total cost for the new program, which would expire in 2021, is estimated to top out at $8 million per year.

Rep. Michael Speciale, R-Craven, questioned the need for the new credit, saying it is the latest attempt to "unravel" the General Assembly's 2013 tax reform effort.

"Were we wrong then that we're trying to redo it?" Speciale asked.

Other lawmakers also criticized the proposal.

Rep. Carl Ford, R-Rowan, called it "reverse Robin Hood" because tax money was being used to enrich developers.

Rep. Jeff Collins, R-Nash, complained that local communities would see the most benefit from the projects but aren't being asked to put any money into the effort.

"Everyone ought to have skin in the game," Collins said. "We should require localities to participate."

Ross said cities and towns often work with developers on projects to reroute water and sewer lines and upgrade sidewalks and streetscapes. Together, they put abandoned, often decaying, properties back on tax rolls and boost nearby economic development efforts, he said.

"What are we trying to accomplish?" Ross asked his colleagues. "We're trying to bring tax money back to North Carolina. We're not sending money off to the moon."

Related Topics

• Credits

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.