Dispute over mortgage interest, deductions stalls tax reform bill

The tax reform plan House leaders are backing is on hold after caucus frictions surfaced in committee Wednesday morning.

Posted — UpdatedThose divisions apparently centered around what might be called the "the Howard Amendment," a tweak to the bill put forward by Rep. Julia Howard, R-Davie, during the House Finance Committee Tuesday.

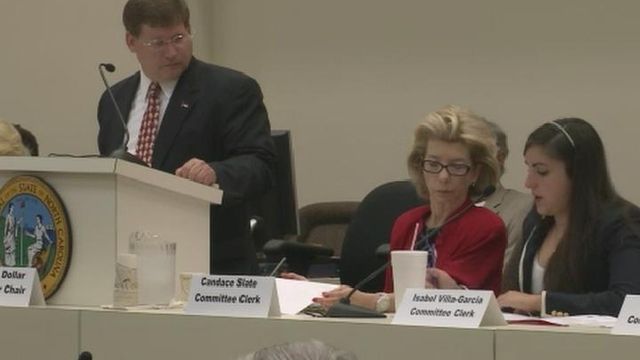

"We will vote this bill out," said Chairman Nelson Dollar, R-Wake, at the beginning of Wednesday's meeting on House Bill 998.

Dollar's fellow caucus members thought otherwise.

Howard, a finance chairman, objected to the motion to bring the proposed committee substitute before the panel for debate.

"I object to the PCS being before you," Howard said, talking over Dollar. "This is not the bill that came out of Finance." A PCS is a proposed committee substitute. It is essentially a rewrite of the bill.

Specifically, the bill was rewritten overnight to roll back the amendment Howard pushed through in House Finance Tuesday. That amendment would have removed a cap on taxpayer deductions for the combination of mortgage interest, charitable deductions and local taxes.

The original version of the bill capped those deductions at $25,000. The version Dollar tried to bring before the Approps committee Wednesday restored the cap, undoing Howard's amendment.

But that debate never got the chance to play out.

Dollar initially refused to recognize Howard's objection, calling for a vote on the motion.

The voice vote was clearly against the motion, but Dollar ruled it had passed, resulting in calls for division – a counted vote – from Republicans and Democrats across the room.

After a roll-call vote, the count was 44-34 against taking up the bill, with Howard, Iler, Arp, Conrad and several other Republicans joining Democrats in voting against the motion.

Dollar adjourned the meeting.

Speaker Thom Tillis, who was in the room, was overheard commenting that it might be time for a caucus meeting.

That seems especially true since it is unusual to see senior chairmen and other party leaders openly disagreeing with one another over a high-profile bill.

"You would have thought that everybody would have voted yes," Stam said, saying that the PCS should have appealed to both Democrats and Republicans.

But Rep. Mike Hager, R-Rutherford, the House Majority Whip, said he voted against the new version of bill because he believed the version with the Howard amendment, and bigger tax cut, should be the version that goes forward.

"That's the bill that should come to the floor," Hager said. Committee members, he added, did not have enough time to consider the new version of the tax bill that came before Appropriations Wednesday morning.

No word yet on when the bill may resurface.

The dust up may be particularly troublesome given that the state party convention is this weekend. Being the first chamber to pass a massive tax overhaul would have been quite a coup for House lawmakers, especially Tillis, who just announced plans to run for the U.S. Senate.

Copyright 2024 by Capitol Broadcasting Company. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.